The Indonesian government intends to introduce a value-added tax (VAT) on crypto asset transactions, as well as an income tax on the profits from investing in digital assets, starting on May 1, a tax official said on Friday, amid booming digital asset trading.

Hestu Yoga Saksama, the Indonesian tax office’s spokesperson, told Reuters in a report on Friday that the country would be assessing “income tax and value added tax” on cryptocurrency funds “because they are considered commodities by the Trade Ministry” and not currencies. The government is still considering how to implement such taxation. However, legislation passed in response to the pandemic laid the foundation for gaining revenue by taxing transactions in digital currencies.

During the recent COVID-19 pandemic, Southeast Asia’s largest economy has seen an increase in demand for digital assets, with the number of crypto asset holders increasing to 11 million by the end of 2021.

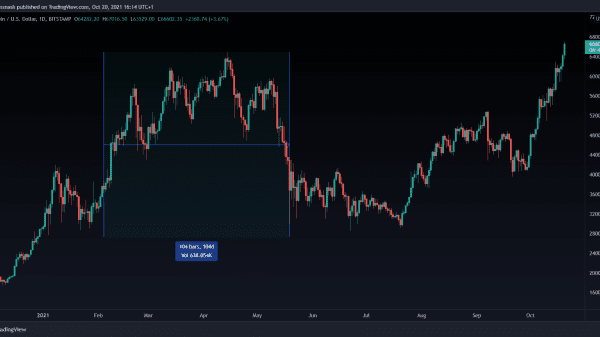

According to data from the Commodity Futures Trading Regulatory Agency, cryptocurrency transactions in commodity futures markets last year totaled 859.4 trillion rupiah ($59.8 billion), up more than ten times over 2020’s transaction amount.

It is legal for Indonesians to trade crypto assets as commodities, but not to use them as payment methods.

Crypto assets will be subject to VAT because they are a commodity as defined by the trade ministry. They are not a currency, So we will impose income tax and VAT.

Hestu Yoga Saksama, Indonesian tax office’s spokesperson

In addition, he said the government is still working on the implementing regulations for the proposed taxes. Crypto assets benefit from low VAT rates, well below the 11% levied on most Indonesian goods and services, while companies’ capital gains income tax follows the same pattern as that imposed on shares, at 0.1% of gross transaction value.

Taxes on crypto assets are based on a wide-ranging tax law passed last year, officials said. In the aftermath of the COVID-19 pandemic, the law was designed to optimize revenue collection.

Despite Indonesia’s government’s preparations for a legal framework for cryptocurrencies, culture appears to play a major role in mainstream adoption. In November, the National Ulema Council, a group of Islamic scholars made up of roughly 87% of Indonesia’s population who identify as Muslims, stated crypto as a means of payment was prohibited under the rules of their religion. Even though the council’s decisions reportedly can be seen as sources of “legislative inspiration,” they are not legally binding in Indonesia.