BlackRock made the announcement about the entities that would be responsible for acquiring bitcoin on the company’s behalf. BlackRock is not permitted by law to buy the cryptocurrency directly. It has been revealed in a filing that the asset management has formed a partnership with J.P. Morgan and the quantitative trading company Jane Street. Another document reveals that in addition to Cantor Fitzgerald, Valkyrie has also designated Jane Street as Chief Executive Officer. There is a high probability that several ETF issuers will have multiple approved participants.

Within the realm of exchange-traded funds (ETFs), an authorized participant is the entity that collaborates with the fund’s issuer to generate and redeem shares of a fund in order to facilitate the ability of an investor to withdraw their money. After a number of evaluations and modifications, this is most likely the last stage in the application procedure for the product that has been anticipated for a very long time, according to the experts.

James Seyffart and Eric Balchunas, analysts at Bloomberg Intelligence, have been attentively examining new S-1s to determine which firms are utilized as APs. It is believed that the disclosure is among the last stages preceding the SEC’s decision. This week, Balchunas stated in a research note that the SEC was prepared to approve proposals for spot bitcoin ETFs with authorized participants who have signed agreements and committed to cash-only creations and redemption.

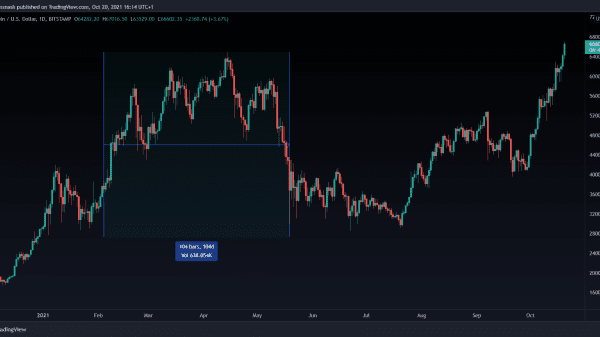

Balchunas and Seyffart concur that the SEC permits some firms to initiate a spot bitcoin ETF in early January with a 90% probability. The regulatory agency must reach a decision on a proposal by Ark Invest and 21Shares by January 10, and it is possible that other similar plans could also be evaluated and ruled on by that time.

The largest fund manager in the world, BlackRock, filed an application with the SEC in June to launch a spot Bitcoin ETF, causing the price of the largest cryptocurrency to soar. Larry Fink, CEO of BlackRock, has since referred to Bitcoin as a “international asset” that “digitizes gold.” The interest of the prestigious fund manager and numerous other prominent Wall Street firms has led analysts to believe that the SEC will eventually grant approval to the long-awaited investment vehicle, which it has been delaying since its applications were denied a decade ago.