In the wake of the Coinbase partnership, BlackRock has announced the launch of its first institutional crypto investment product: a bitcoin trust that provides direct exposure to the spot price of Bitcoin. In a statement issued on Thursday (August 12, 2022), BlackRock announced the launch of its first bitcoin investment product. This is a bitcoin trust that offers institutional clients in the US direct exposure to the spot price of the largest cryptocurrency by market capitalization. According to the company, the new product offering has been introduced as a result of increased interest from big money clients.

Despite the steep downturn in the digital asset market, we are still seeing substantial interest from some institutional clients in how to efficiently and cost-effectively access these assets using our technology and product capabilities.

BlackRock said in the announcement

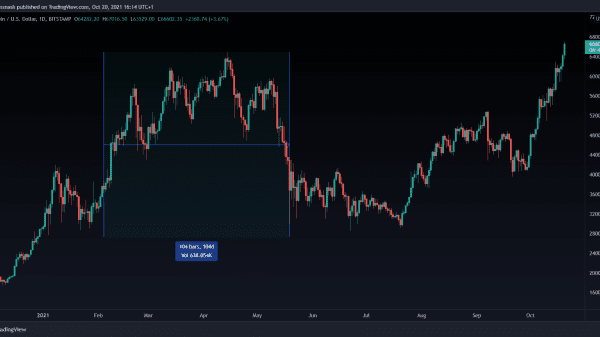

Despite its all-time high of almost $69,000, the price of bitcoin is still more than 60% below its current low. While the stock market appears to be at a bottom, many investors believe that the economy might have also found a bottom with stocks, with the two asset classes more correlated to each other this year than ever before, in spite of the declines in risk assets since 2022.

The digital currency gained over $24,700 on Thursday, its highest level since before it fell to its lows at the end of June, making it its highest level since then. Earlier this year, BlackRock’s CEO Larry Fink announced that BlackRock clients had been showing increasing interest in digital currencies, including stablecoins, and the underlying technologies that underlie them also known as blockchain technology.

Additionally, BlackRock praised the work of non-profits EnergyWeb and RMI on Thursday, saying they are taking steps to bring greater transparency to the sustainable energy usage in bitcoin mining and that the company will pay attention to the progress around these initiatives.

BlackRock has been researching topics with the potential to benefit our clients and the capital markets more broadly, including permissioned blockchains, stablecoins, cryptoassets, and tokenization, according to the post.

In an attempt to get its arms around the crypto market, BlackRock announced the news on Thursday. With about $8.5 trillion in assets under management, the company recently announced a new partnership with Coinbase that would allow its institutional clients to buy digital assets, beginning with bitcoin, through a one-to-one relationship.