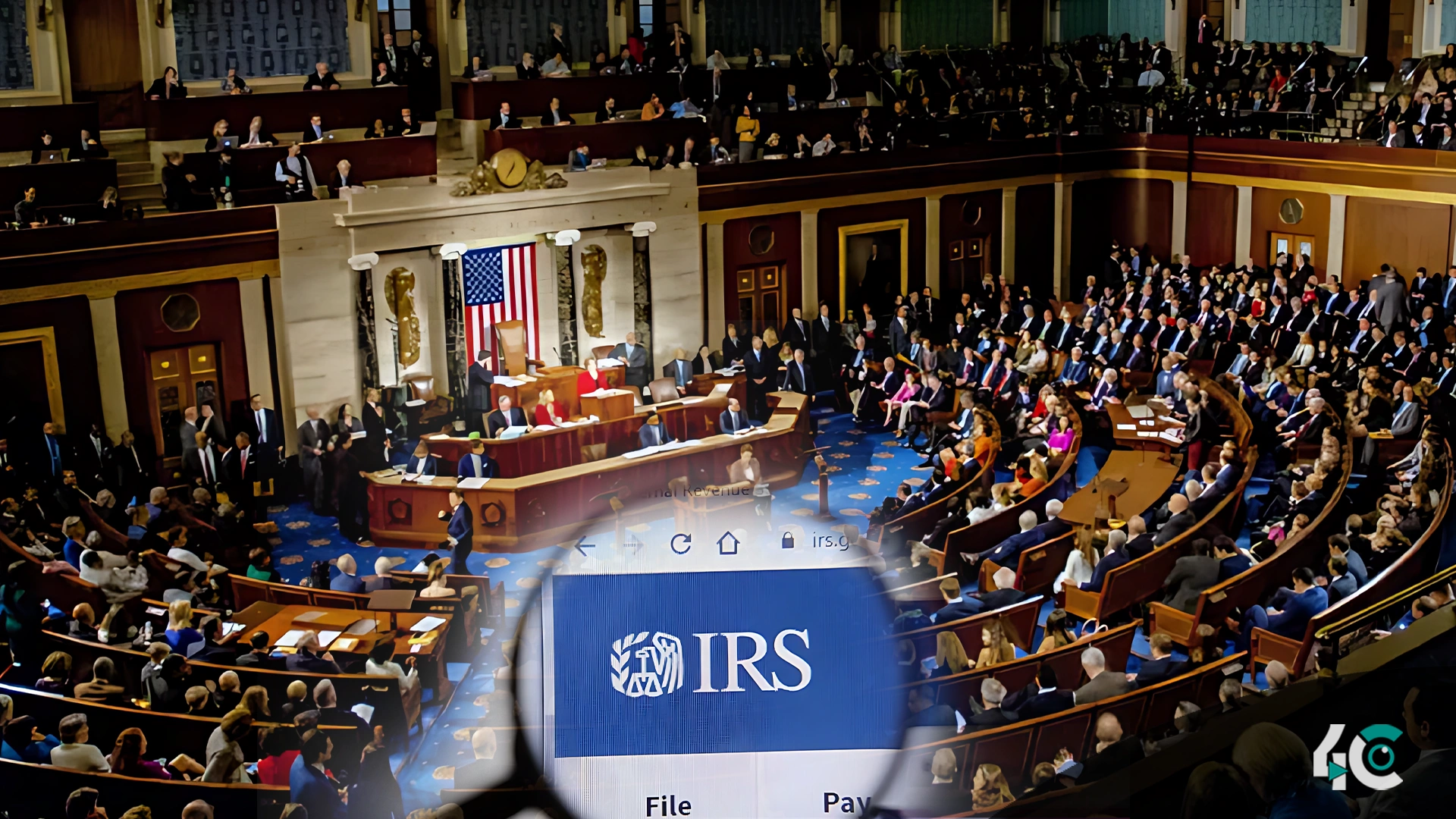

The US Senate has decided to remove an IRS rule expanding tax reporting obligations to decentralized finance (DeFi) systems, therefore marking a significant step toward restructuring crypto laws. Approved with a strong 70-27 majority on March 4, the resolution now travels to the House of Representatives for more clearance.

The regulation at issue sought to expand current IRS broker reporting responsibilities to include DeFi platforms, thereby compelling them to reveal transaction data, including taxpayer information. Opponents of the law contended that it was unworkable and burdened developers and infrastructure providers—who do not behave as conventional brokers—unnecessarily.

The approval of the resolution signifies a triumph for the cryptocurrency sector since many see it as an essential action to safeguard privacy and invention. Emphasizing the need to maintain technological leadership in the sector, Kristin Smith, CEO of The Blockchain Association, praised the choice as a major win for DeFi and the larger US crypto business.

Originally supporting the IRS rule, the Biden administration found mounting bipartisan opposition in Congress. Legislators from all sides voiced worries about the possible effect of the rule on innovation and the constitutional problems with its application. Proponents of the repeal contend that the IRS rule overstepped its authority and that current tax laws already demand people to disclose their crypto income.

The resolution must now pass the House before reaching the desk of President Donald Trump, notwithstanding Senate approval. Trump has said he supports eliminating the IRS regulation; hence, should the legislation pass the last obstacle, he most likely will sign it into law.

If the House follows suit, this decision could set a standard for how crypto-related rules are handled in the US. This would support the need for a balanced strategy that makes sure tax laws are followed and encourages new ideas.