Trump’s tariffs’ impact on crypto markets has become a focal point as traditional assets reel from policy changes. Despite volatility in global markets, cryptocurrencies show surprising stability. This resilience underscores the evolving role of digital assets amid economic uncertainty.

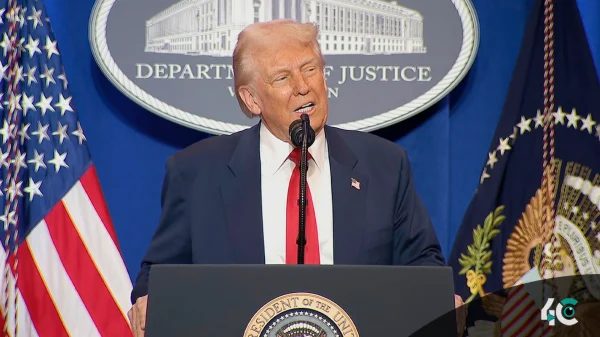

On April 2, President Donald Trump announced import tariffs that would shake up the economy. With the new announcement, the baseline tariffs with a tariff of 10% have been made for all goods coming to the US. 54% is for heavy-going countries. The street is abuzz with chatter on Liberation Day, which is now set to be effective from April 5, with the full measure taking effect by April 9.

The unexpected decision sent big indexes crashing down by trillions in a single day. Some analysts believe we have already passed the peak of uncertainty. Trump’s move to publicize the policy has made the economic environment easier yet trickier to navigate for investors.

The condition of peak uncertainty might serve as the onset of gradual recovery, especially for crypto. Now that the tariff details are known, market players can start recalibrating their bets. Bitcoin, for instance, demonstrated notable strength. After a brief dip to 81,000, it swiftly rebounded above the crucial support level at 82,000. Since then, it has remained stable, which is encouraging, given the current circumstances.

Prices of cryptocurrencies are indicative of sentiment shifts as they trade for 24 hours. After many days of accumulating gains, Bitcoin managed to dip to 81,000 but quickly shifted above the strong support level of 82,000, where it is currently staying put amidst the turmoil seen in other markets. Some analysts think the Fed could cut rates or start a new round of quantitative easing because the economic impact of tariffs has been worse than expected. Such measures would certainly benefit the crypto assets and attract more investors.

However, not everyone is optimistic. Doubters warn that investor caution will continue, especially if Trump continues to tinker with or undo his policy in the coming weeks. This uncertainty could potentially weaken the demand for investors to restrict their short-term gains in equity and digital assets.

Geopolitical reactions remain an unpredictable factor. Major U.S. trading partners, such as China, Japan, Mexico, and South Korea, are preparing to unveil their measures soon. How these countries will respond to the tariffs appears to be a significant question that could influence financial markets in the coming months.

While it has unnerved investors, it could potentially serve as a pivotal moment in the economy. Despite the current calm, both crypto and traditional markets still face challenges and opportunities for growth.