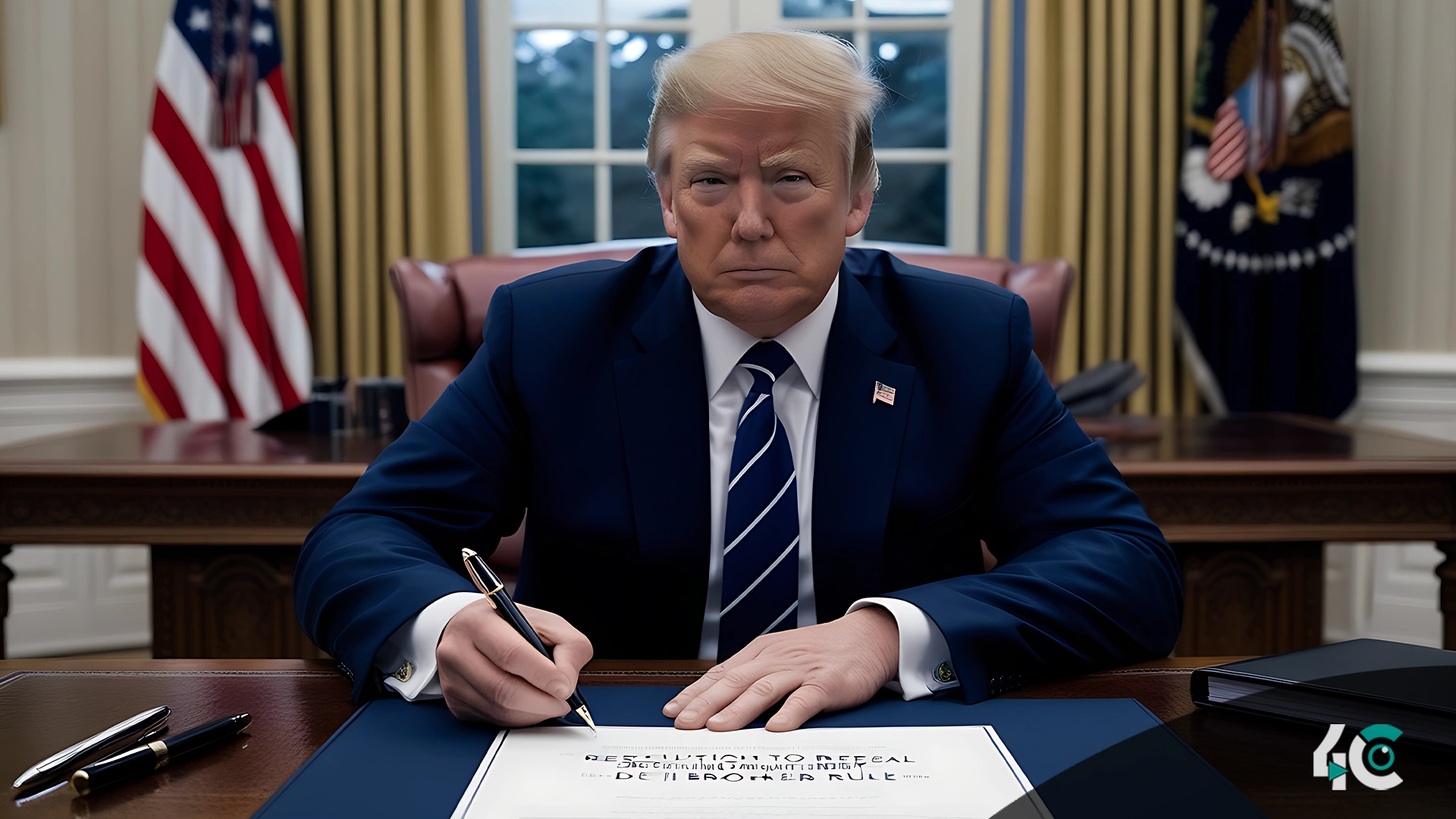

President Donald Trump has repealed a controversial IRS rule targeting decentralized finance (DeFi) platforms in a historic move for the cryptocurrency sector. The rule that no longer exists was brought in during the Biden administration, which was imposed on DeFi services to collect taxpayer information for a detailed transaction data ratio.

Originally set to roll out in 2027, the rule sought to redefine “broker” to encompass DeFi services, compelling them to report gross earnings from user crypto trading and transfers. Industry experts say that the requirement is overly intrusive, technically unfeasible, and potentially crippling innovation.

Representative Mike Carey, who was a strong supporter of the repeal, viewed the effort as “one for the books.” This is the first time a crypto-related bill has been signed into law,” he said, noting this rule would have flooded the IRS while undermining American leadership in the digital asset economy.

Earlier this year, it passed the House with strong bipartisan support before clearing the Senate on March 26. With Trump’s approval all but guaranteed, the White House made clear he would sign it.

The repeal has brought relief to many crypto enthusiasts. Industry heads stated that the rule could have sent innovators abroad, making the U.S. less competitive globally for crypto. Privacy advocates also expressed concern about the broad reporting requirements, which they believe would infringe users’ rights and add more burdens to the already-strained IRS.

Kristin Smith, chief of a top crypto advocacy group, said the rollback represents a lifeline for developers and entrepreneurs. “This provides the industry space to take a breath again,” she said, adding that the rule threatens the future of the U.S. crypto ecosystem directly. People described it as a blow to the engine of innovation.

The decision also features measures preventing the agency from issuing similar mandates without approval from Congress, limiting their regulatory overreach in the DeFi space.

In line with this pro-crypto ruling, the Trump administration has increasingly positioned itself as a proponent of cryptocurrency. With the IRS rule off the table, the crypto community can move forward in a manner that focuses on technology, privacy, and keeping needless regulatory burdens to a minimum.

Amidst this evolving landscape, the crypto ban repeal seems to support future laws aimed at fostering innovation instead of restricting it while providing enough oversight. The repeal of the IRS rule is not just a win for the crypto community but also an opportunity for hope.