Once President Donald Trump officially confirmed his government’s intention to do an examination, the likelihood of a formal audit of Fort Knox’s gold reserves attracted momentum. His comments set off a flood of market speculation, especially on venues where people gamble on political and economic events.

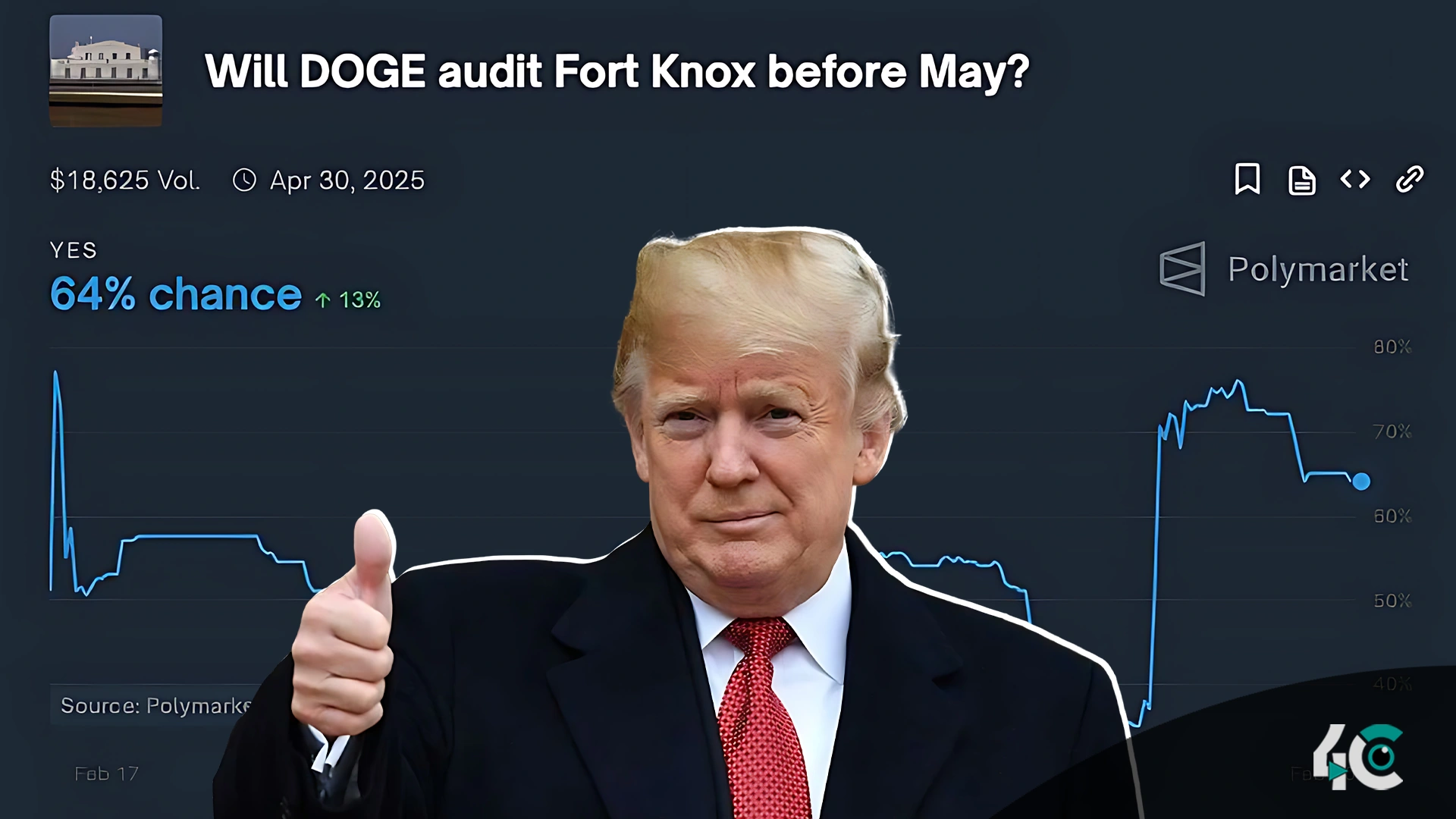

On February 19, Trump pledged his will to confirm the gold kept at the famous repository on a journey to Washington. He said his government intends to visit Fort Knox to make sure the reserves stay whole. The declaration increased activity on prediction markets, where chances of an audit before May 2025 exceeded 70%.

Trump’s announcement coincides with growing interest among political leaders and economists, many of whom have long argued for more openness on the gold reserves of the country. Although officials have repeatedly claimed that the reserves are safe, this audit will be the first official evaluation of Fort Knox’s gold since 1974.

Trump did not specifically address the issues behind the audit, but he did recognize the ramifications of any differences. He underlined his hope that “everything is fine” with the reserves, but he also underlined that should any anomalies be discovered, it would raise questions.

Based on Trump’s remarks, Polymarket, a prediction tool based on cryptocurrencies, observed a sudden rise in audit-related betting activity. One of the markets displaying speculation on whether missing gold would be found displayed a 17% chance of this. Concurrently, another well-known prediction tool is apparently getting ready to open comparable markets centered on Fort Knox-related events.

The fresh focus on Fort Knox also fuels debates about the function of gold in financial stability and more general consequences for economic policy. According to certain market analysts, especially in alternative assets like cryptocurrencies, just doing an audit could have major impact on investor mood.

All eyes stay on the administration’s next actions as expectations rises. Should the audit go as scheduled, it would probably be among the most keenly followed financial events of the year, with possible effects on both conventional and digital sectors.