In January, the stablecoin market value on Solana’s blockchain increased from $5.1 billion to $11.4 billion, a record high. This quick growth was fueled by increased activity in memecoin trading, making Solana a popular alternative among crypto traders looking for speedier and more cost-effective transactions.

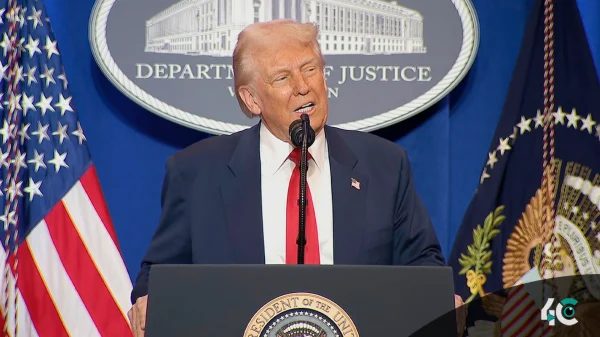

The emergence of Trump-branded memecoins contributed significantly to this rise. On January 18, former US President Donald Trump proposed a cryptocurrency based on Solana, swiftly followed by the MELANIA token. These launches generated a wave of speculation, resulting in a significant increase in stablecoin issuance and inflows to the Solana network.

By mid-January, Solana’s stablecoin supply had increased by more than 73%, outperforming most other networks. While Ethereum remains the leading force in decentralized finance (DeFi), with $54.8 billion in total value locked up, Solana’s quick rise indicates its growing importance in the cryptocurrency sector. Solana also outperformed Ethereum and Base in stablecoin transfer volume in January, with a remarkable $1.6 trillion in transactions.

Despite Tether’s USDT leading the global stablecoin market with a market capitalization of almost $140 billion, Circle’s USDC dominates on Solana, accounting for nearly 80% of the stablecoin supply. Circle continues to ramp up issuance in early February, adding another $250 million in USDC, bringing the weekly total to $1.25 billion.

Solana’s network has also experienced an increase in decentralized exchange (DEX) activity, with daily volumes reaching a record $28.2 billion on January 18 and $39.2 billion on January 19, coinciding with the launch of Trump-related tokens. These advancements have cemented Solana’s position as a top network for memecoin and stablecoin trading.

The blockchain’s ability to perform more than 65,000 transactions per second increases its appeal. Following a system upgrade in late 2024, Solana’s transaction speeds have increased, offering it a viable option to Ethereum for merchants seeking efficiency and cost savings.

While Solana’s stablecoin growth is great, USDT remains the world’s most traded stablecoin, with USDC coming in second. USDC, on the other hand, led in annual growth, increasing by 78% by 2024, demonstrating its growing usage.

As regulatory concerns for Tether develop in the European Union, Solana’s expanding stablecoin ecosystem may position it as a dominant player in the emerging crypto scene. With large institutions looking into Solana-based investment products, the network’s momentum shows no signs of slowing.