The United States Securities and Exchange Commission (SEC) collected a record-breaking $8.2 billion in financial penalties and fines in fiscal year 2024. A $4.5 billion settlement with Terraform Labs and its creator, Do Kwon, largely prompted this milestone, the greatest in the agency’s history. The enforcement came after the collapse of Terraform’s blockchain ecosystem in 2022, resulting in huge financial losses.

Despite a 26% decrease in enforcement cases from the previous year, pecuniary remedies increased as a result of this high-profile case. Without Terraform’s contribution, the SEC’s total collections would have been $3.72 billion, representing one of its lowest years since 2013.

Breakdown of Penalties and DisgorgementsIn 2024, the SEC collected $6.1 billion in disgorgement (funds recovered from illegal earnings) and $2.1 billion in civil penalties. These data demonstrate the agency’s dedication to holding wrongdoers accountable and returning funds to harmed investors.

Under outgoing SEC Chair Gary Gensler, who will leave in January 2025, the agency retained its reputation as a strict enforcer of financial regulations. Despite criticism from cryptocurrency enthusiasts, Gensler described the SEC as a “steadfast cop on the beat,” protecting market integrity and investors.

Impact on the Cryptocurrency Sector.The SEC’s attitude toward cryptocurrency firms has been one of its most contentious issues during Gensler’s leadership. While crypto-related enforcement charges decreased from 46 last year to 11 in 2024, fines collected increased by more than 3,000%, owing mostly to the Terraform Labs settlement.

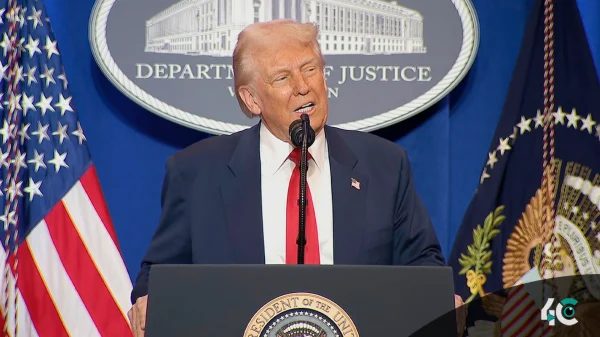

The entire bitcoin business is already bracing for a potential regulatory shift under the new administration. President-elect Donald Trump has promised to relax regulatory monitoring of cryptocurrency businesses, raising optimism that the SEC’s tough attitude may soften in the near future.

Looking ahead.The SEC’s record year brings an end to an important chapter in the agency’s history, as it transitions to new leadership in 2025. The SEC has established itself as a prominent force in financial enforcement, collecting more than $8 billion, including significant payments to damaged investors. However, the future of cryptocurrency regulation under a new administration is uncertain, paving the way for significant adjustments in the coming years.