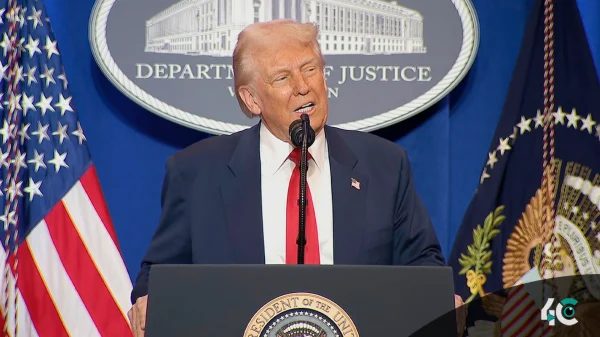

The bitcoin market surged as the US government delayed proposed tariffs on Canada and Mexico. This decision, made following conversations between US President Donald Trump and the leaders of both countries, has offered relief to global financial markets, including the cryptocurrency sector.

Canadian Prime Minister Justin Trudeau acknowledged the temporary accord, which suspends the 25% tariff for at least 30 days. Canada pledged to reinforce its border policy by investing $1.3 billion in additional security measures, such as establishing a fentanyl czar and expanding staff and aerial monitoring.

Similarly, Mexican President Claudia Sheinbaum announced the cessation of duties on Mexican exports to the United States. The deal includes measures to strengthen border security and resolve major trade concerns. However, Trump later stated that he may impose tariffs if necessary while the negotiations were underway.

The cryptocurrency market reacts positively.

Following these occurrences, the cryptocurrency market soared. Bitcoin surpassed $100,000, recovering from a low of $92,000. Ethereum also rallied, rising beyond $2,800 after falling to $2,451. The Crypto Fear & Greed Index, which measures market mood, has shifted into the ‘greed’ zone, indicating rising investor optimism.

Market observers believe that the tariff pause has reduced uncertainty, prompting traders to reinvest in digital assets. Some believe that if trade tensions continue to diminish, cryptocurrencies may reach new all-time highs.

Analyst Insights

Crypto industry experts believe there is potential for long-term growth. Uncertainty largely drove the recent outflows, but the tariff suspension has reinvigorated confidence in digital assets, according to a leading market analyst. Another industry leader highlighted that if the tariff threat continues to diminish, Bitcoin could quickly reach new record levels.

Additionally, a proposed executive order to establish a sovereign wealth fund under the U.S. Treasury and Commerce departments could further bolster the digital asset space. Some analysts believe this move signals a pro-crypto stance from policymakers, fostering long-term market growth.

Long-Term Outlook

While the crypto market remains sensitive to global economic shifts, the latest tariff developments have provided a temporary boost. If trade tensions remain subdued, the digital asset sector may continue its upward momentum, attracting more investors seeking alternatives amid inflation concerns and currency fluctuations.

With markets responding positively, the coming weeks will be crucial in determining whether this rebound is sustained or if geopolitical uncertainties trigger further volatility.