The Consumer Financial Protection Bureau (CFPB), which oversees financial institutions and mandates, will play a diminished role in regulating the cryptocurrency industry going forward, as the action will most likely rest with the SEC and state authorities. As per the legal expert Ethan Ostroff, this shift is in tune with the overall plan of the administration for regulatory simplification and federal cutbacks.

Ostroff said that state agencies, including New York’s Department of Financial Services and California’s Department of Financial Protection and Innovation, will probably have a bigger hand in crypto policy. Some functions will stay at the CFPB due to laws from Congress, but generally, it seems that the bureau’s powers over crypto will be reduced significantly.

We do not anticipate the complete dissolution of the bureau. The agency will continue to operate as Congress sets legal standards, but its scope will narrow. Congress’s legal requirements maintain the consistency of the CFPB. Though the scope may narrow, the organization will stay.

Pursuant to the Consumer Financial Protection Act, I have notified the Federal Reserve that CFPB will not be taking its next draw of unappropriated funding because it is not "reasonably necessary" to carry out its duties. The Bureau's current balance of $711.6 million is in fact…

— Russ Vought (@russvought) February 9, 2025

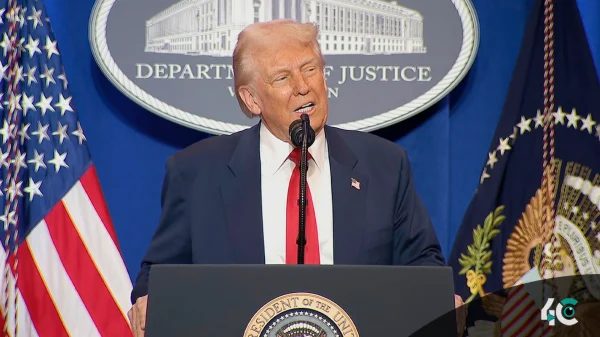

The CFPB was affected by the push to cut spending by the Trump administration. Since taking office earlier this year, the new agency head, Russell Vought, has made funding cuts and reduced operations to align the bureau with the administration’s cost-cutting agenda.

Some critics, like Massachusetts Senator Elizabeth Warren, who helped create the CFPB, have voiced their disapproval at this shift. Warren opposes the measure, saying it gives industry more power while reducing consumer protection. Congress alone has the authority to alter or dismantle the agency, she asserted.

As regulation intensifies, state regulators and other federal agencies will be scrutinized for their role in shaping the future of crypto policy in America. This change illustrates the debate over the most effective methods to safeguard customers while still utilizing technology and implementing efficient regulations for this asset.