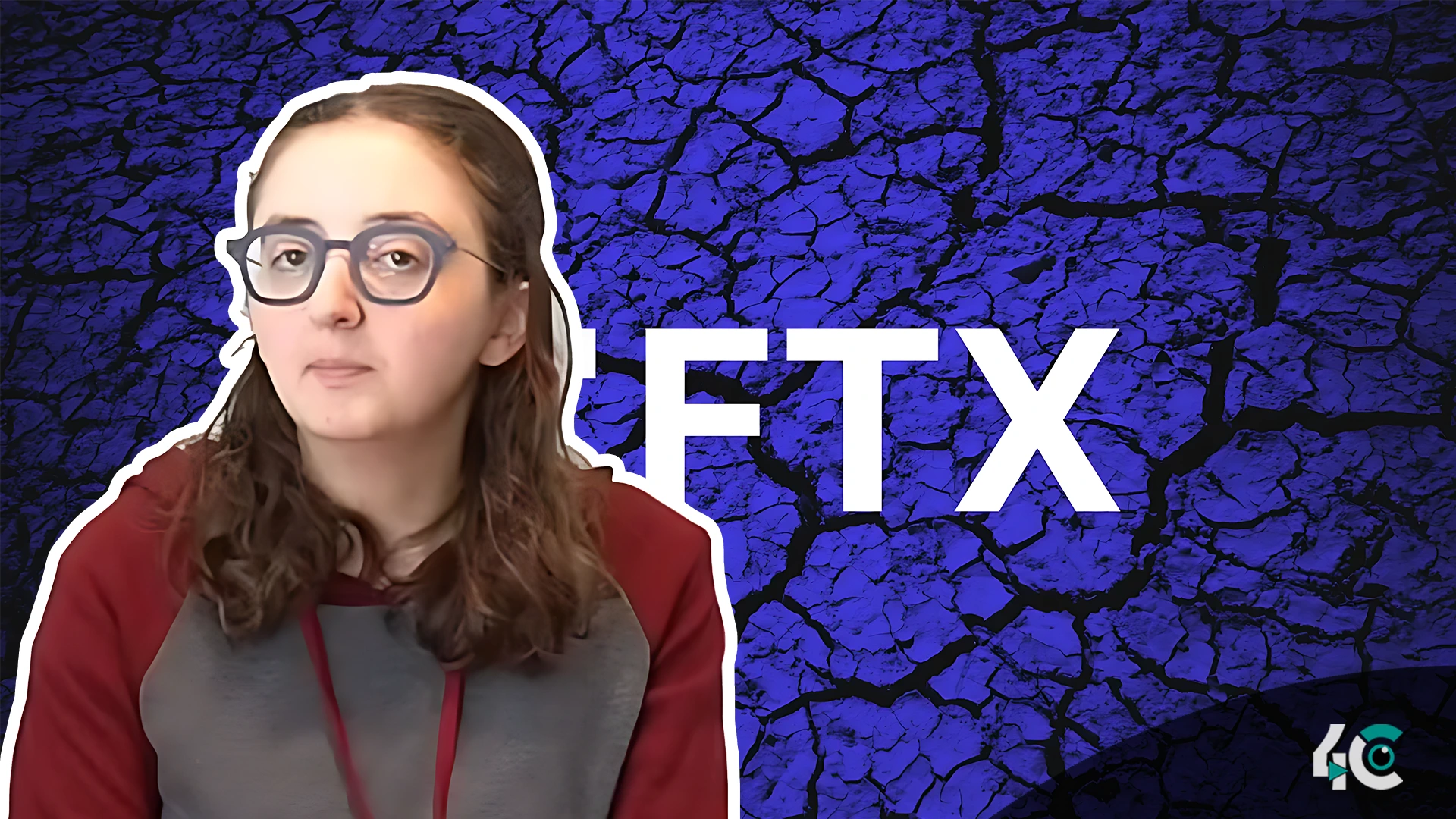

Caroline Ellison used to be the CEO of Alameda Research. She has agreed to a deal with FTX’s bankruptcy estate in which she will give up almost all of her assets. This deal is part of the ongoing work to get back money that was lost when FTX went bankrupt in 2022, leaving many creditors looking for payment.

Ellison put in a court move on October 7 that laid out the terms of the deal. Ellison will have to give up any property that hasn’t already been taken by the government as part of her criminal case or used to pay her lawyers’ fees. Ellison will only keep some personal items after following the terms of the deal. It’s not clear what the exact value of the lost goods is.

Ellison also agreed to help FTX with its current court battles and investigations. She might be able to give useful documents or information from her time as head of Alameda Research. FTX thinks that this agreement and the money they got from the deal are very valuable because they keep the case from going to court again, which would have taken more time and cost more money.

Before, FTX’s bankruptcy estate sued Ellison in July 2023, saying she had broken her duty as a trustee and stolen money, including $22.5 million in bonuses from February 2022 and $6.3 million from 2021. The estate also tried to get back call options and FTX stock that were said to have been given to her.

On November 20, the court will look over the deal again. FTX said that Ellison’s resources would be drained by continuing the lawsuit, so the deal was the better option. FTX thinks that Ellison’s support is very helpful because it helps them get back more assets for creditors.

Ellison was sentenced to two years in jail in September 2024 after helping the prosecution build their case against FTX founder Sam Bankman-Fried. Ellison was a key figure in the theft of FTX customers’ money. This agreement got Bankman-Fried a lighter term and gave important evidence that helped convict her.

The court accepted FTX’s bankruptcy plan on October 7. The plan tries to get back between 118% and 142% of the value of claims made by former customers and crypto holders based on what happened when FTX filed for bankruptcy in November 2022. The deal with Ellison is another step toward making sure that creditors get paid back from the failed exchange.