2021/12/09 at 07:59 am ET

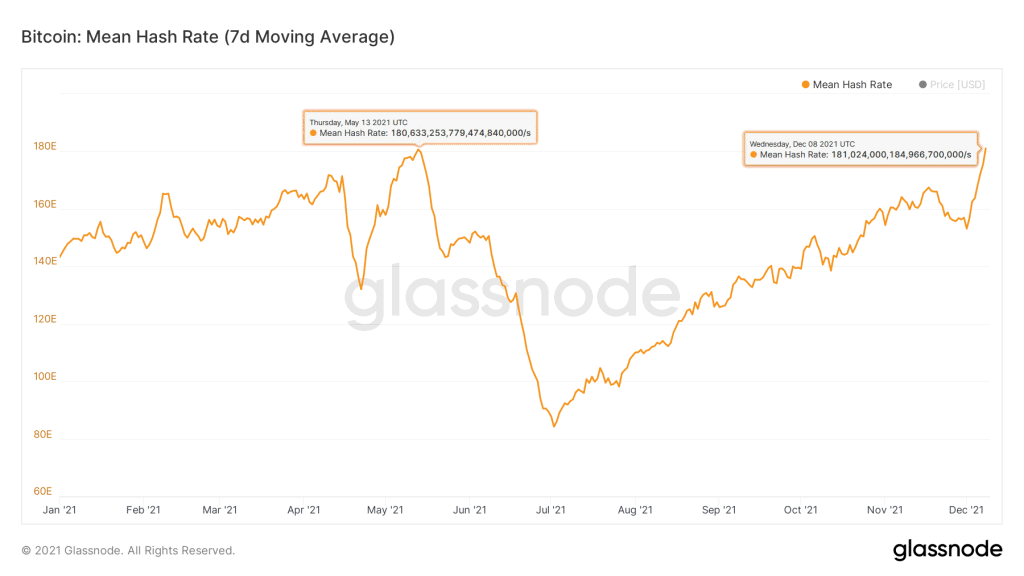

As of Dec 8th, Bitcoin hash rate on 7D MA broke the previous high of 180.6E from May 13th making new ATH of 181.02E, recovering from a drop to a near 2-year low of 84.3E on July 2nd followed by a Chinese government crackdown on Bitcoin miners.

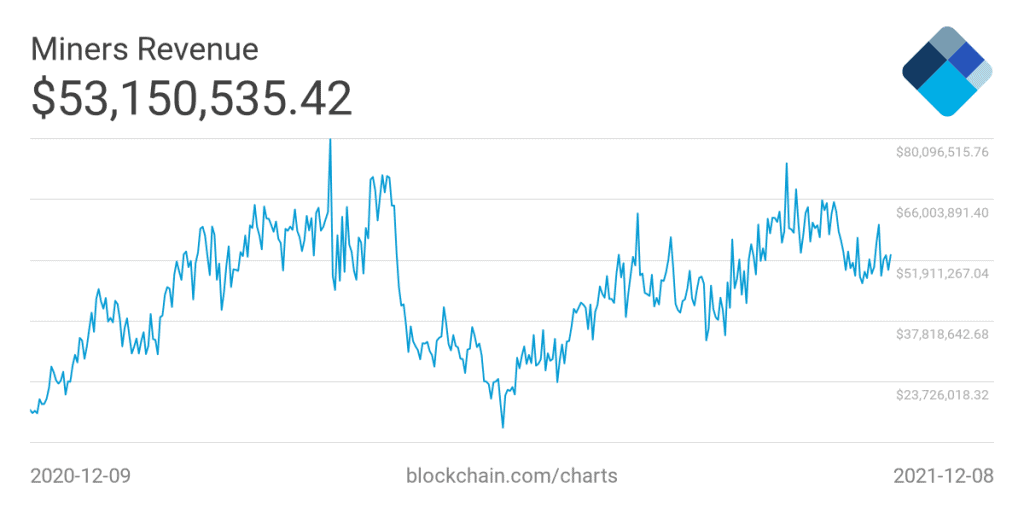

While the Hashrate has recovered completely the miner revenue currently seats at $53.15M

2021/12/01 at 10:33 am ET

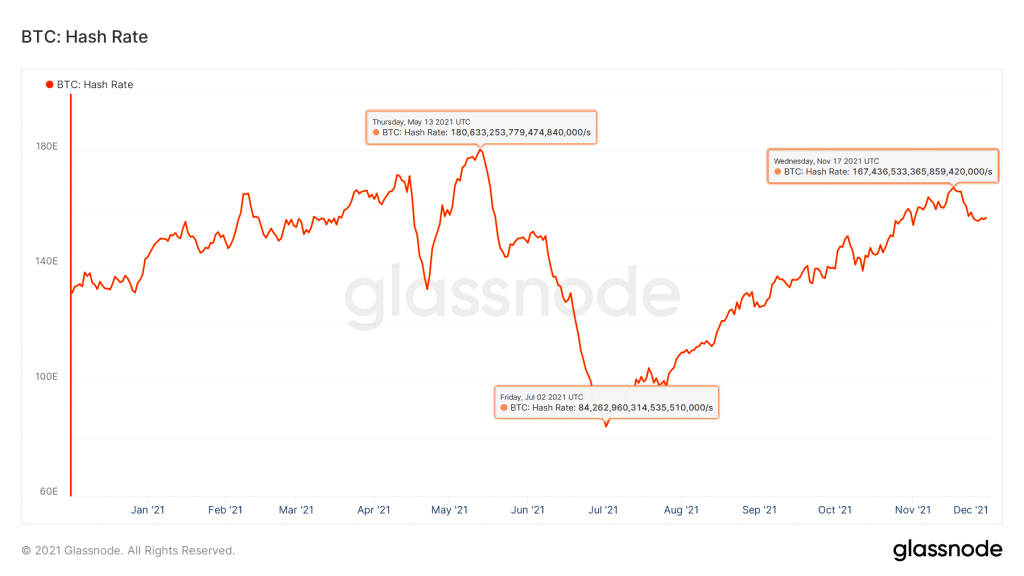

The 7-day moving average of Bitcoin’s hashrate has risen nearly 98.57% to 167.4E (Nov 17, 2021), after it fell to a near 2-year low of 84.3E on July 2nd. As a result, Bitcoin’s current hash power needs to rise another 7.30% in order to reach its all-time high of 180.6E last seen in May 2021. Based on on-chain data, it appears that the network’s computational power will climb even higher in December, possibly reaching a new high as published in Kraken Intelligence report. In addition to this, Bitcoin’s appreciation led to an unprecedented 9 consecutive positive difficulty adjustments. This led to a total +65.8% increase in mining difficulty and a high of 22.7T, the highest level in 5 months.

During the crackdown on Bitcoin by China the country who used to have the highest hashrate, a significant number of miners were forced to shut down. This caused the total hashrate of the Bitcoin network to plummet to 84.3E in early July. As of this writing, the metric has almost completely recovered and sits around 148.5E, less than 16% away from reaching a new record high. On November 17, the top was made at 167.4E and it has since retreated from that top. Bitcoin’s hashrate has seen exceptional resilience since bitcoin mining was banned in China, climbing over 80% in five months to reach its previous peaks.

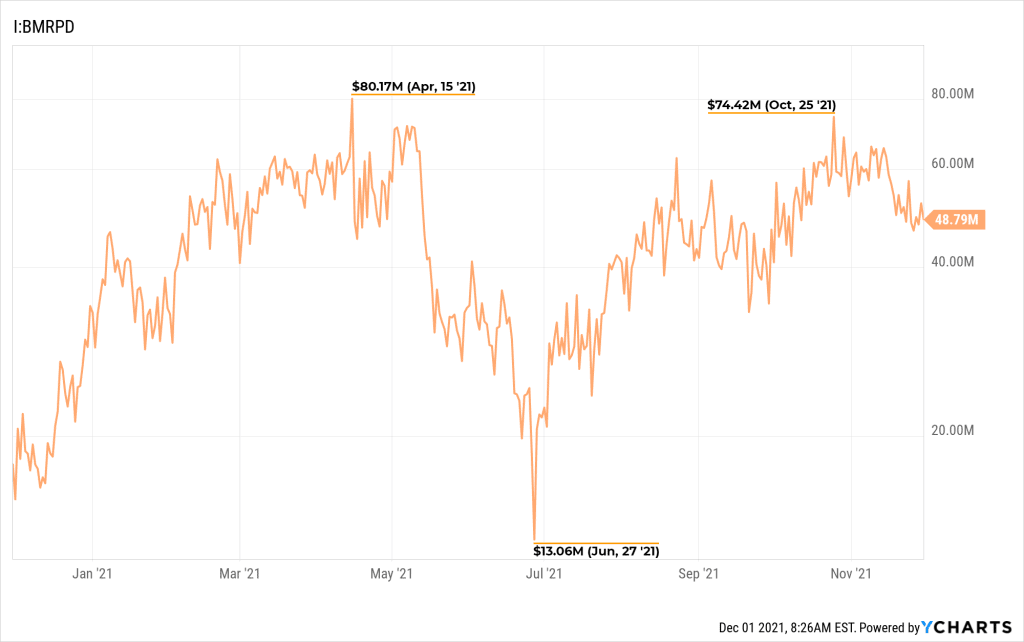

Another aspect of bitcoin mining is mining revenue, or the amount of Bitcoin miners receive for running the network. To judge the profitability of the industry and how likely it is that more investments and hash power will land in the Bitcoin network in the future, it is important to understand how much bitcoin miners earn per day. Over the past five months, BTC miner revenue has been increasing, and it has already surpassed its pre-ban levels. Mining revenue is almost at an all-time high and is still growing. BTC’s daily miner revenue has increased from $13.06M in late October to more than $74M just under the record of $80.17M set in April 2021.

It is incredible how the Chinese crypto ban is benefiting other countries and the Bitcoin network itself. China’s ban had the exact opposite effect on Bitcoin mining than one would expect after being banned by a major world power. Despite China’s focus on the digital yuan and the ideologies underlying it, decentralized cryptocurrencies like Bitcoin and Ether will be increasingly seen as open, democratic alternatives.

The Cryptosphere continues to grow stronger despite the constant challenges that its users and markets face. The emergence of Blockchain technology by institutions and governments and understanding of its benefits is likely to lead to cryptocurrencies becoming more popular among regulators, institutions, and individuals, driving the adoption of cryptocurrencies even further.