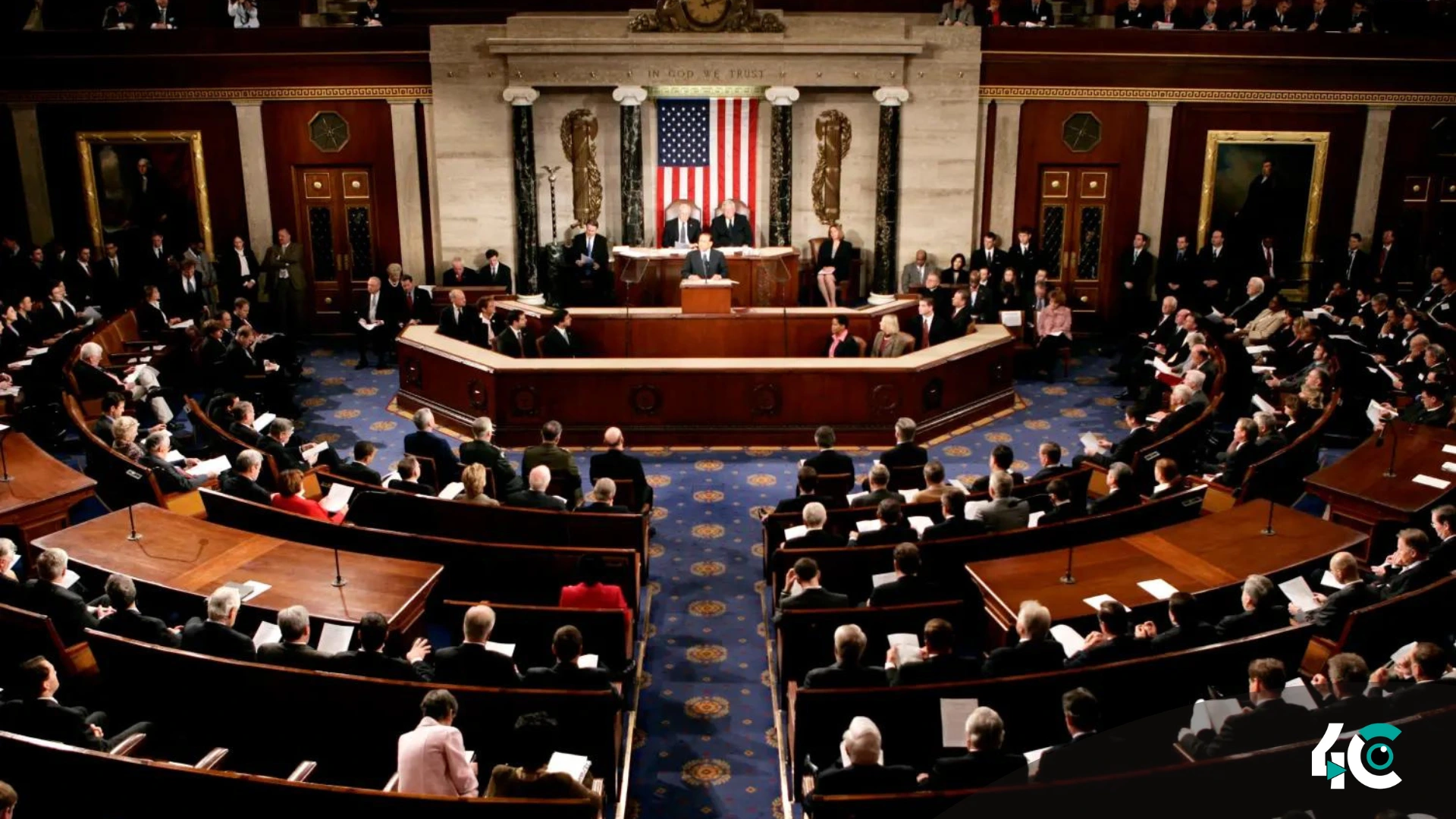

In a historic session, U.S. lawmakers held the first meeting in Congress on decentralized finance (DeFi). They spoke out against the technology’s risks and potential, giving their differing opinions. The meeting, called “Decoding DeFi: Breaking Down the Future of Decentralized Finance,” was held by the House Financial Services Committee on September 10. Its goal was to look into how DeFi could change the financial world and the problems it brings.

The almost two-and-a-half-hour meeting made it clear that people have different political views. On one side, Republican politicians talked about how DeFi allows for new ideas and freedom by getting rid of middlemen in financial transactions. They said that decentralized methods could make the banking system work better and help more people. Representative French Hill, a Republican, set the tone by saying that DeFi could change markets by letting people do business with each other directly instead of going through traditional banks.

But Democratic politicians were very worried about the bad side of DeFi. They said that it could be used for criminal things like tax evasion, breaking bans, and fraud. Representative Brad Sherman, a Democrat, said that DeFi mostly helps the rich dodge paying taxes, which is good for everyone else. He said that the method was “a way for billionaires to avoid paying taxes and following the rules.”

Representative Maxine Waters brought up recent cyberattacks on DeFi projects as another example of the dangers. She wondered if the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC), which are two of the current regulatory bodies, could handle the growing problem of independent platforms that don’t follow the rules.

At the meeting, witnesses spoke on both sides of the issue. Chief legal officer at DeFi Education Fund Amanda Tuminelli agreed with the idea that DeFi makes money available to anyone with an internet link, which is different from standard banking and helps people feel more included. But Mark Hays, a senior policy analyst at Americans for Financial Reform, warned about how volatile DeFi was and how it could put investors at risk of scams. He pushed for existing securities rules to be applied to the business.

Check out my opening statement here: https://t.co/4O41s2jBU7

— Amanda Tuminelli (@amandatums) September 10, 2024

Peter Van Valkenburgh, head of research at Coin Center, said that officials need to make it easier for businesses to follow the rules. He stressed that tax evasion shouldn’t be a reason to keep too close an eye on and control financial systems too much. Lawmakers and experts talked about DeFi’s future role in finance at the meeting. They were trying to figure out how to balance new ideas with the need for regulation and customer protection. Some politicians see DeFi as a game-changing technology, while others see it as a possible threat to financial safety and trust. This shows how hard it is to regulate