According to the blockchain-based prediction market Polymarket, Donald Trump is leading the field in the final days leading up to the November 5 U.S. presidential election. An unidentified high-stakes investor, known as a “whale,” has boosted Trump’s winning odds to nearly 67% by placing an additional $2 million wager on him. This sizeable gamble with USD Coin (USDC) has improved Trump’s reputation on the site, where users may forecast actual events using decentralized markets.

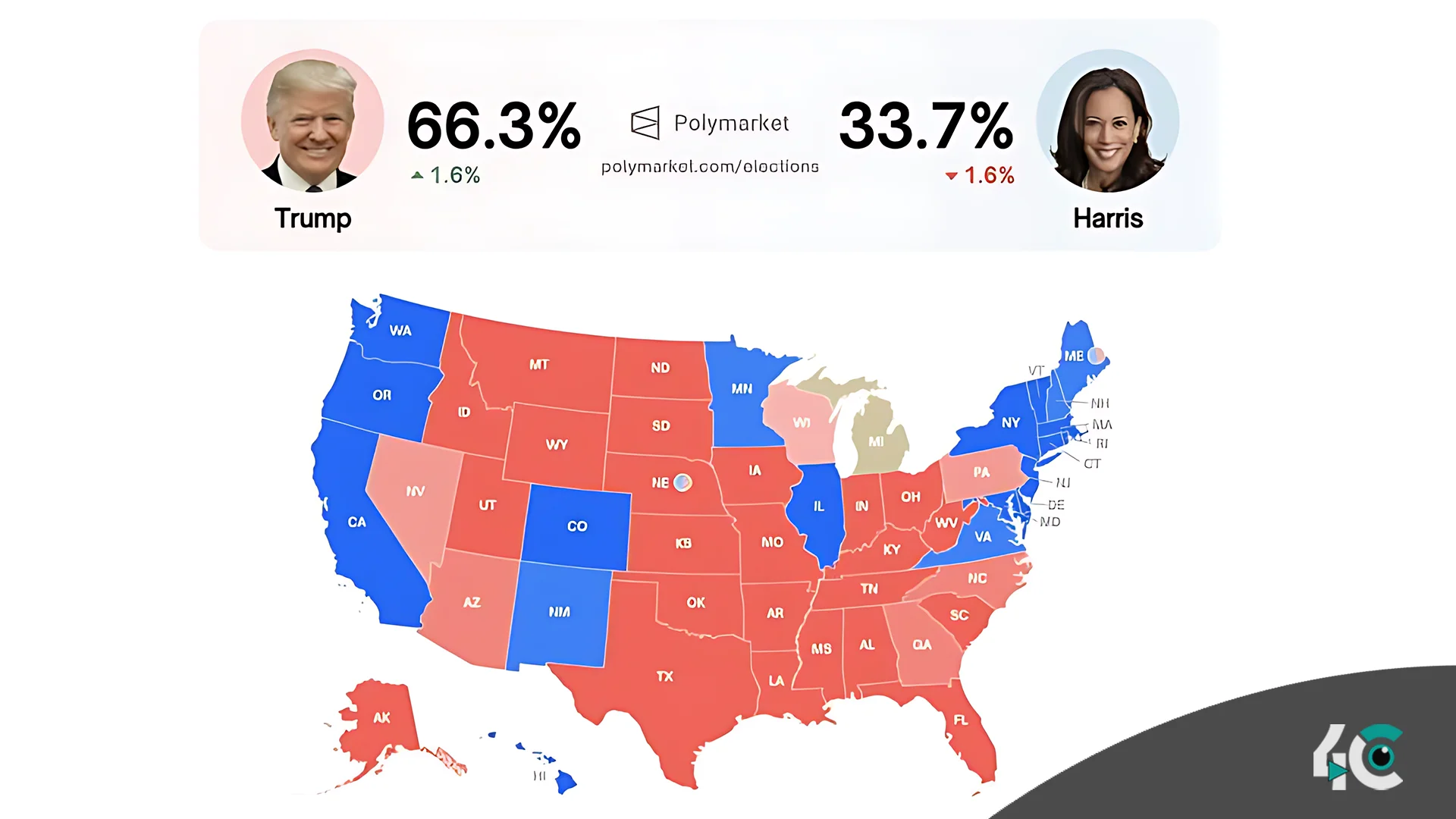

On October 28, Trump’s election odds rose to 66.3%, according to data from Polymarket. An unidentified whale, who has already contributed $7.22 million in support of Trump since October 11 and purchased over 11 million “yes” shares, was the main force behind this change. According to blockchain data analytics company Lookonchain, the whale has an unrealized profit of about $256,000 from these wagers.

Pre-election prediction markets like Polymarket are popular. Elon Musk, a tech entrepreneur, and other observers have pointed out that blockchain-based platforms, which show investor opinion in real time, can offer information that conventional polling techniques miss. Beginning in early October, Trump’s odds shifted to the lead and have continued to rise.

Under the pseudonym “zxgngl” on Polymarket, the whale responsible for this rise has a sizable ownership of Trump-supporting “yes” shares. This person is distinct from other Trump backers on the site, such as “Fredi9999,” who made significant investments in the past but used the Kraken exchange to finance transactions. On the other hand, Binance is the main source of funding for zxgngl’s account; their most recent deposits total hundreds of thousands of dollars.

Global investors are becoming more interested in blockchain-based prediction markets like Polymarket. From $463 million in the second quarter to $3.1 billion in the third quarter alone, prediction market activity increased by more than 565%. This pattern demonstrates the increasing confidence in blockchain technology’s ability to influence market sentiment, particularly as investors turn to these decentralized platforms to predict the results of the US election.

As election day approaches, decentralized markets are increasingly contributing to the measurement of public opinion and providing alternative perspectives on voter forecasts, particularly as large wagers continue to impact Trump’s prospects.