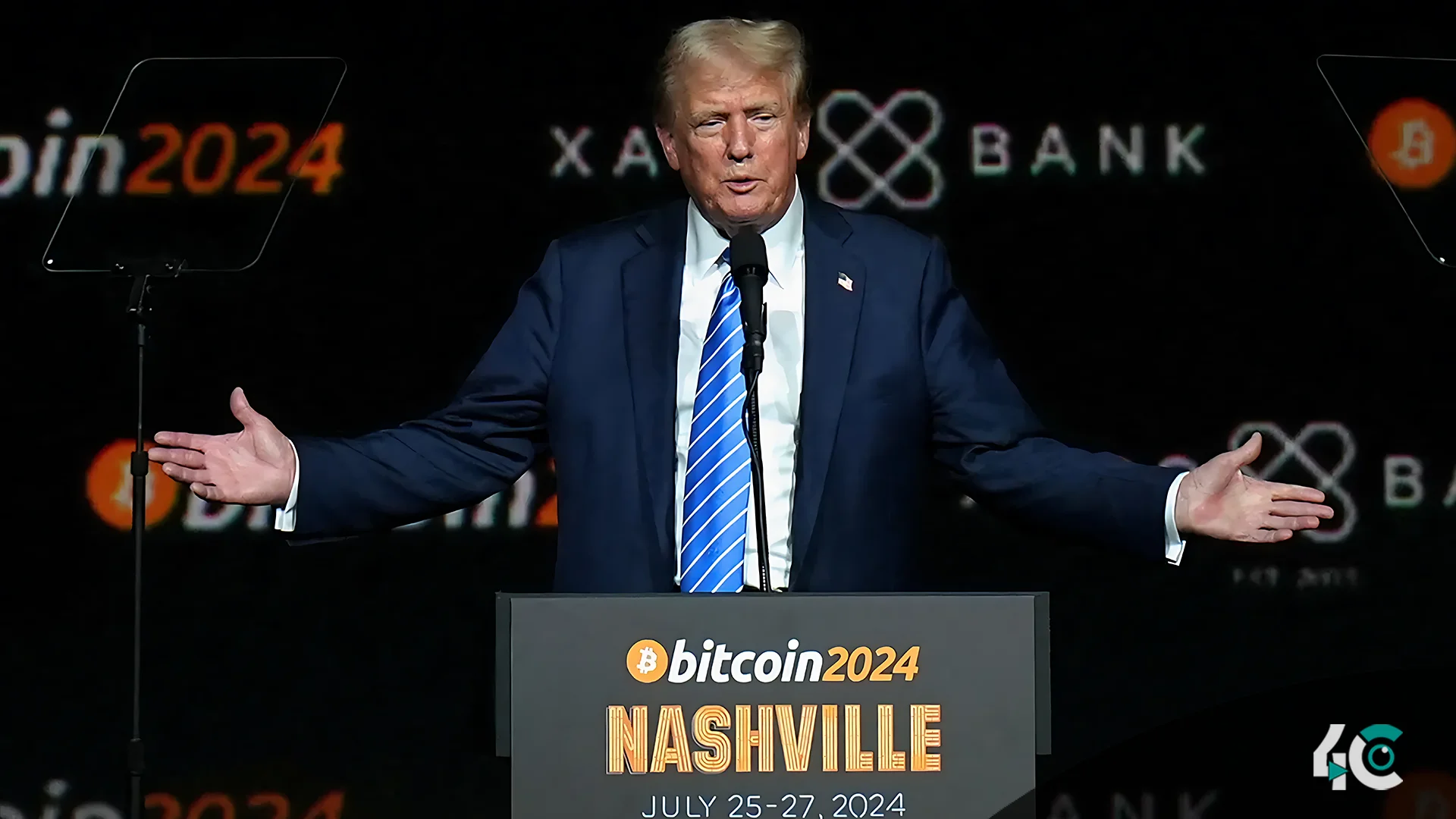

As President-elect Donald Trump prepares to implement his crypto-friendly agenda, top leaders from the digital asset market are avidly seeking spots on the new crypto advisory council. Trump has pledged to build a Bitcoin strategic reserve throughout his campaign, and this council is likely to impact US cryptocurrency rules and policy.

Ripple, Kraken, and Circle are among the companies vying for a position on the council, along with famous venture firms such as A16Z and Paradigm. Industry executives want to have a role in how the US government handles bitcoin, since this will influence the future of digital asset legislation and policy.

Trump’s transition team is still discussing the structure and operations of the council. Trump’s transition team expects the council to function either as an integral part of the National Economic Council or as a separate institution. One of its key roles will be to advise on cryptocurrency legislation, collaborate with Congress, and coordinate efforts across regulatory agencies.

Trump’s aspirations to be a “crypto president” and his determination to reverse the previous administration’s restrictive crypto laws have fueled industry euphoria. This effort for a more crypto-friendly attitude has already contributed to Bitcoin’s recent surge beyond $100,000, as many investors anticipate positive regulatory reforms.

Executives including Coinbase CEO Brian Armstrong and Circle CEO Jeremy Allaire have already expressed interest in joining the council, indicating that key crypto players want to influence the country’s digital asset policy. The crypto sector is closely monitoring the details of the advisory council, given the lack of clarity.