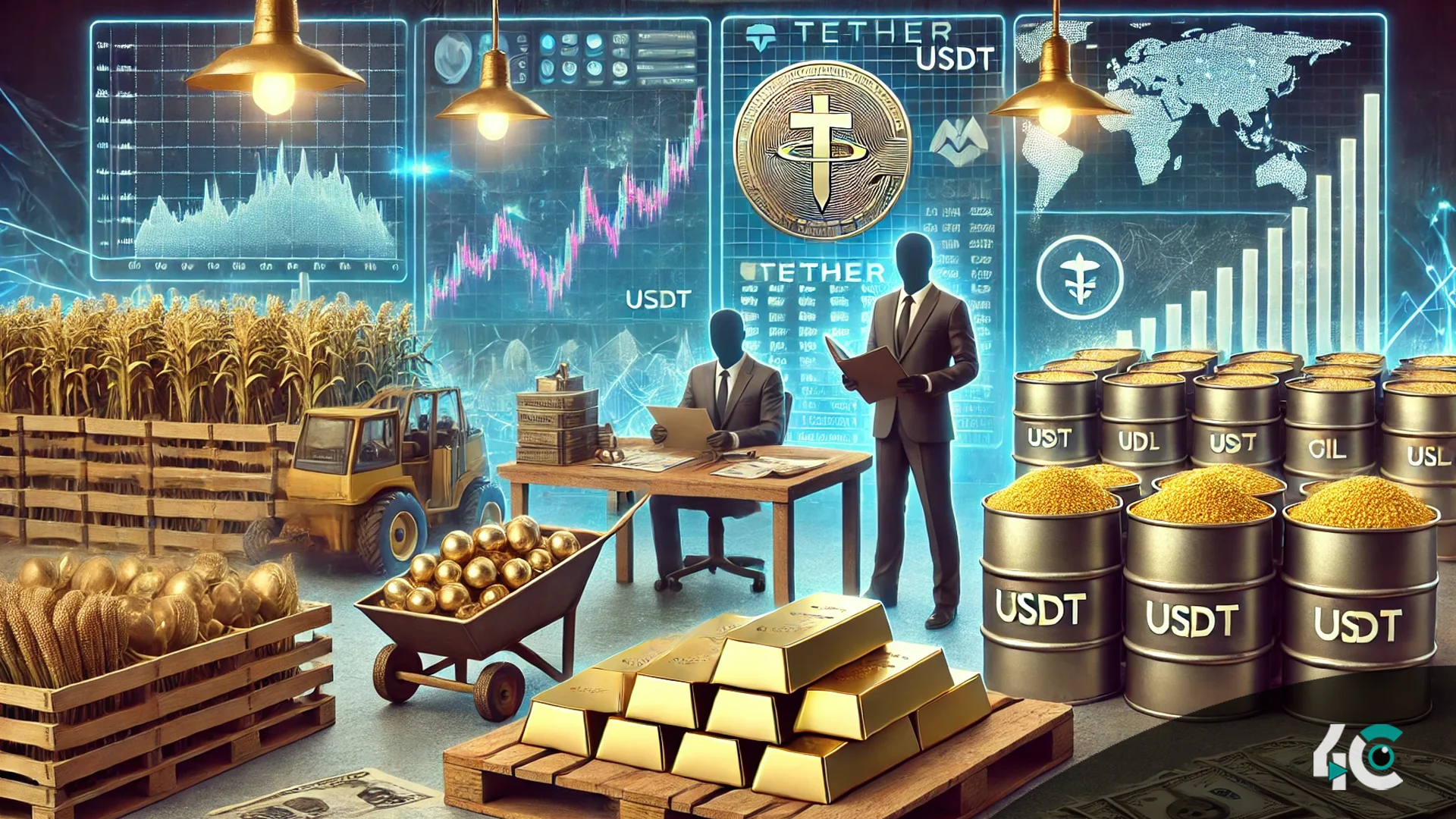

Behind the extensively used stablecoin USDT, Tether Holdings Ltd., is investigating new financing prospects in the commodities trading industry. A new analysis claims that Tether has been in negotiations for loan provision in U.S. dollars with many commodities trading companies. This possible action fits the company’s larger plan for using its enormous earnings—which total billions of dollars.

The conversations take place at a period when Tether is looking for methods to increase its influence in conventional finance, especially in the commodities trading space. To finance significant shipments of commodities like oil and valuable metals, this industry mostly depends on credit. Tether sees a chance to help these companies financially, particularly those engaged in derivatives trading—that is, futures contracts. These contracts are crucial instruments for institutional investors to hedge against market swings, and traders wishing to take advantage of their positions also support them.

Supported by the expansion of its USDT stablecoin, Tether claimed record-breaking revenues of $5.2 billion in the first half of 2024. Tether guarantees liquidity and stability for its customers by stating that U.S. dollar-denominated assets totally support its stablecoin. USDt has a market valuation of almost $120 billion as of October, therefore it is a major player in the stablecoin market.

Paolo Ardoino, Tether’s CEO, verified that the business is currently in early phases of formulating its lending to commodities industry policy. Ardoino underlined that the corporation is precisely defining its strategy to these new prospects, even if the details of the plan are yet unknown.

Apart from investigating lending, Tether has been reinvested its earnings into other sectors, like artificial intelligence infrastructure, renewable energy, mining of Bitcoin, and even education. The company’s entry into these industries emphasizes its desire to diversify and open fresh paths for development outside of the bitcoin industry.

Tether’s possible foray into commodity financing marks a major turning point in bringing digital finance into line with conventional markets as it develops. The business is still determining how much to allocate to this sector and how it would change the financial scene.