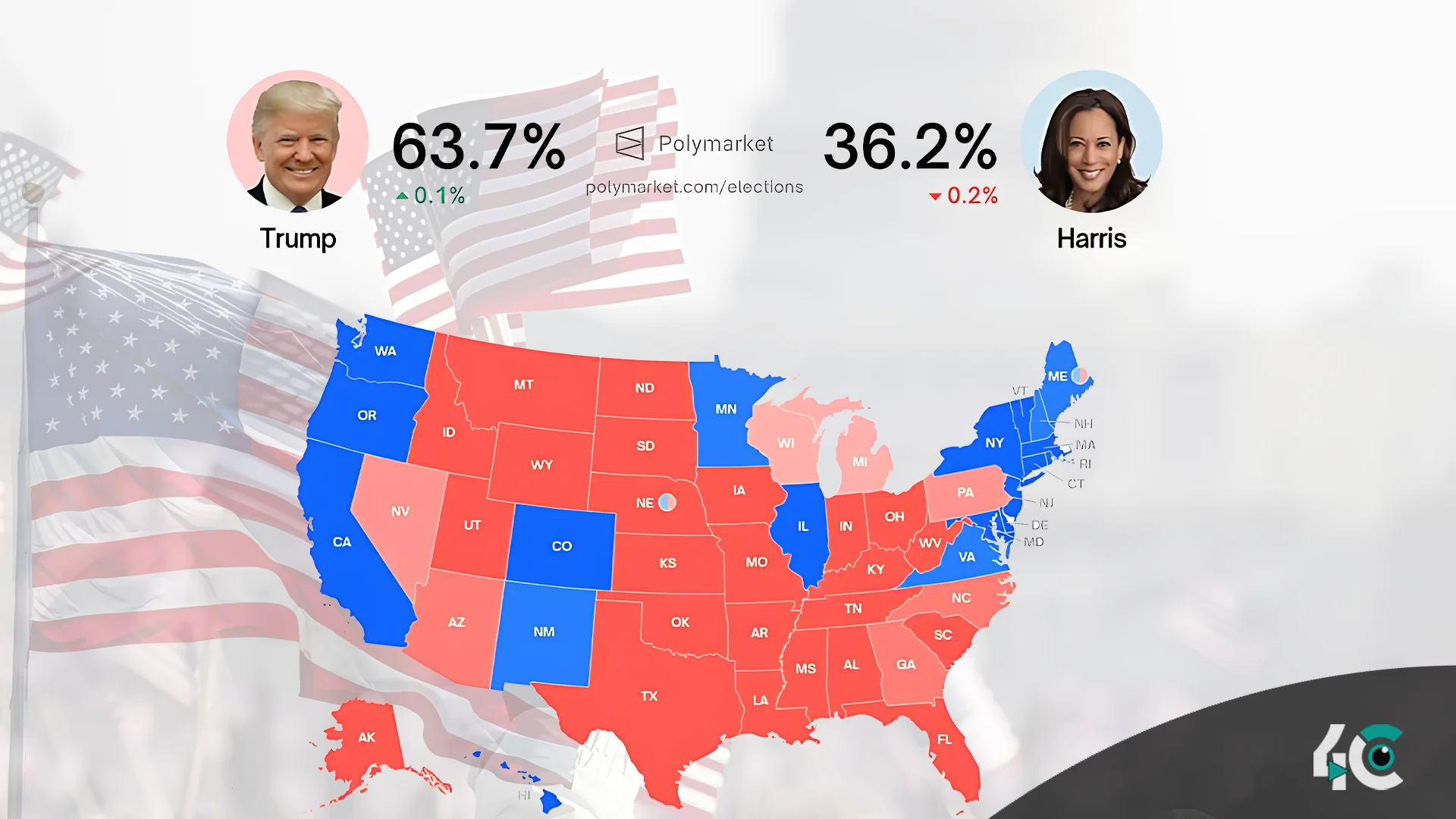

The odds of Donald Trump winning the 2024 U.S. presidential contest have dropped dramatically on Polymarket, a bitcoin-based prediction tool, to reach 63.7%. However, voter polls present a different picture, with some still favoring Vice President Kamala Harris. Concerns about a small number of big gamblers, also known as “whales,” affecting these odds in favor of Trump have surfaced; therefore, Polymarket is looking more closely at its customers.

Polymarket has started reviewing its user base, particularly those placing significant wagers, to guarantee adherence to its restriction on U.S. involvement. Although the platform has mechanisms in place to stop American visitors from seeing the website, some may be getting around these limitations via VPNs.

According to a recent analysis, a few big investors are making a significant portion of the bets, particularly those that boost Trump’s chances. These whales are reportedly pushing the odds in Trump’s favor with one prominent story, “Fredi9999,” which wagers over $20 million on Republican results.

The latest Reuters/Ipsos poll shows VP Harris leading former Pres. Trump 46% to 43% in the US election.

— Steve Hanke (@steve_hanke) October 22, 2024

Polymarket, the world's largest prediction market, shows Trump leading Harris 63.7% to 36.3%.

PREDICTION MARKETS = OBJECTIVE & UNBIASED.

POLLING = SUBJECTIVE & BIASED. pic.twitter.com/InYMcmByyN

With roughly $2.3 billion in wagers on the forthcoming election, Polymarket’s market has grown somewhat favorable for Trump over Harris. Other prediction systems, such as Kalshi, also show Trump leading with 60% chances. Notwithstanding this, national polls show another picture, one that gives Harris a modest lead of 46% over Trump’s 43%. A recent Reuters survey among other sources supports this.

The operations of Polymarket have generated debate, particularly in view of past media coverage implying manipulation in favor of Trump. The creator of Kalshi, a rival site, argued Polymarket’s accuracy, noting that Harris’s median bet is more than Trump’s ($58) average. Harris averages $85.

Investor Mark Cuban, who owns Polymarket, also chimed in saying most of the money entering Polymarket for this election comes from outside. He so minimized the relevance of these wagers as a mirror of real American voter attitude.

Following Polymarket’s 2022 settlement with U.S. authorities, when the platform agreed to pay $1.4 million for providing unregistered binary option markets, this dispute follows. Given Polymarket’s increasing importance in the scene of election betting, the present research is part of a continuous effort to guarantee compliance with U.S. rules.