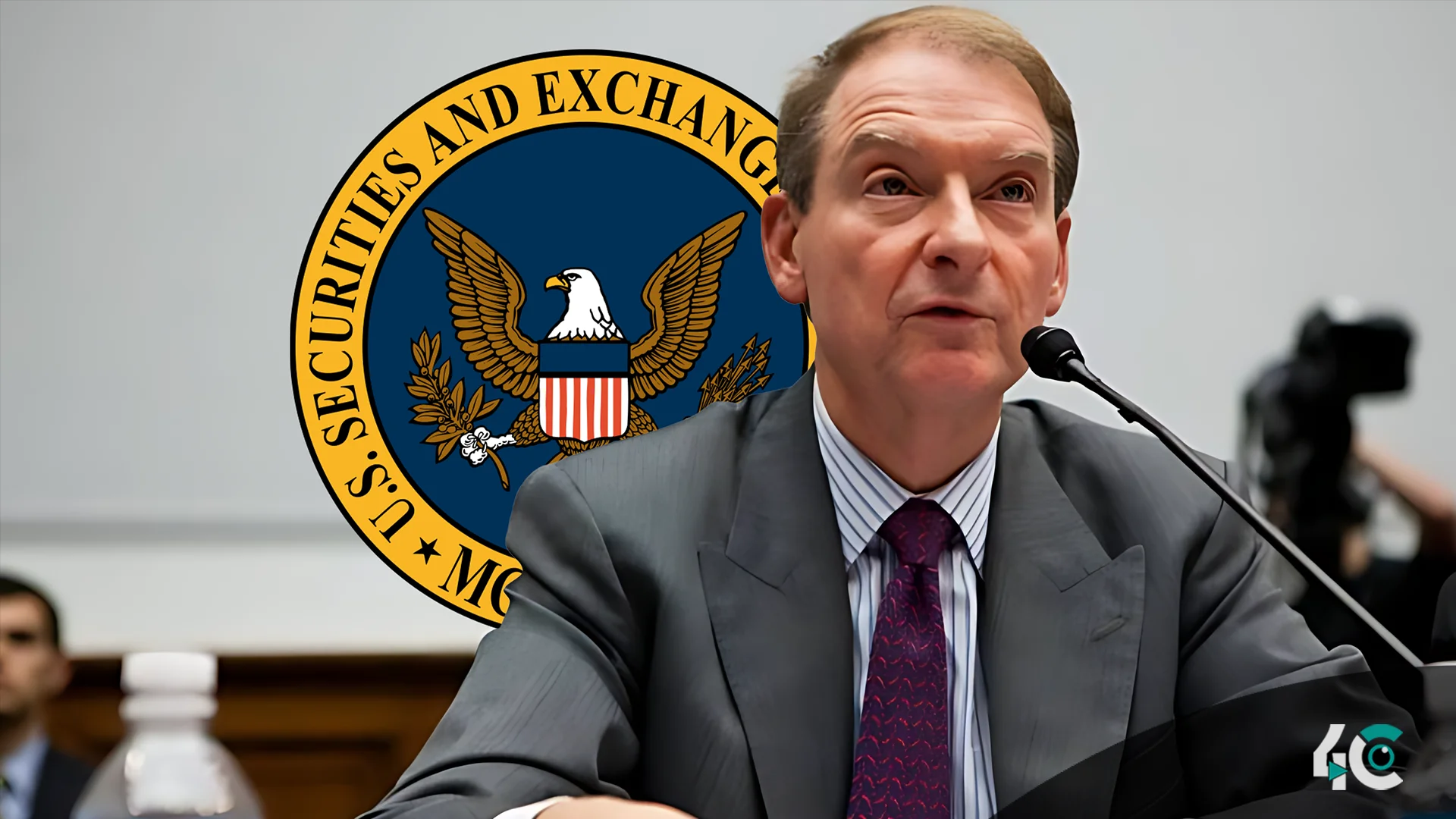

Paul Atkins, a former SEC commissioner, is the top candidate to run the agency under President-elect Donald Trump. Atkins, known for his balanced regulatory stance and support for innovation, is considered a possible bitcoin industry booster.

Atkins’ leadership could signal a shift away from the enforcement-heavy policy of outgoing SEC Chair Gary Gensler, whose tenure has been criticized for impeding innovation through harsh regulatory measures. Gensler, who is leaving his position in January 2025, led a slew of lawsuits and enforcement actions aimed at cryptocurrency firms, a tactic that many industry leaders considered restrictive and ineffective.

Atkins has long been known for his expertise in securities law and forward-thinking approach to digital assets. We anticipate that his appointment will foster a regulatory environment that encourages technological progress while ensuring adequate protections. This proposed transition is consistent with broader Trump administration intentions, which reportedly include shifting cryptocurrency jurisdiction from the SEC to the Commodity Futures Trading Commission (CFTC).

Trump’s administration is reportedly considering establishing a dedicated White House position focused on cryptocurrency policy. This decision demonstrates a rising recognition of the sector’s economic importance and the necessity for a comprehensive regulatory approach.

As Trump finalizes key selections, Atkins’ probable leadership at the SEC is seen as a step toward revamping regulatory methods that balance investor protection and innovation. The adjustment could lead to a more constructive connection between regulators and the fast-developing bitcoin industry.