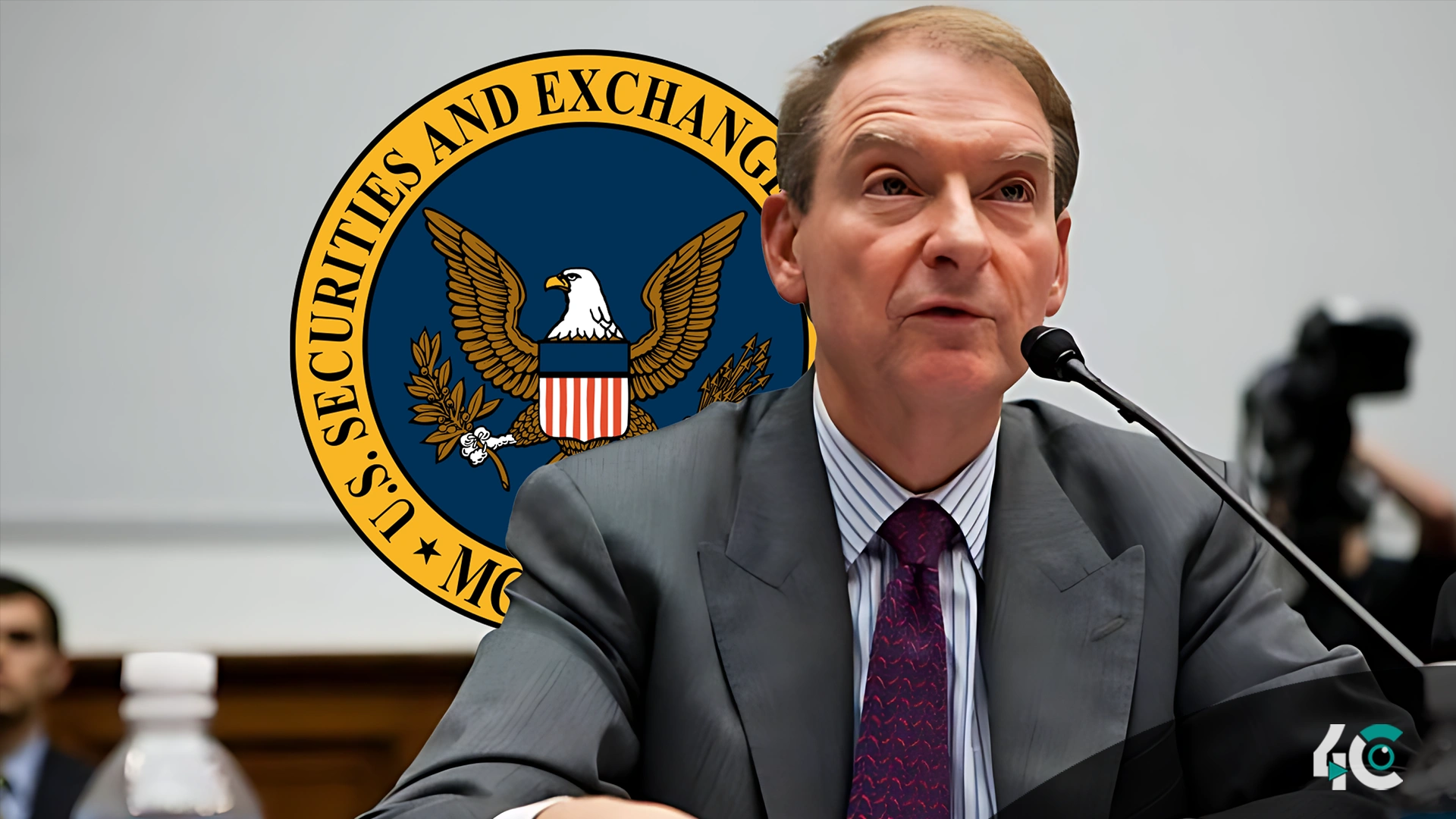

The appointment of Paul Atkins as the 34th Chairman of the U.S. Securities and Exchange Commission (SEC) could potentially transform the regulatory landscape for cryptocurrencies. Known for his business-friendly stance and prior experience as an SEC commissioner from 2002 to 2008, Atkins is expected to advocate for clearer and more accommodating regulations for digital assets. His appointment has been met with optimism from the crypto community, anticipating a shift away from the previous administration’s stringent enforcement approach.

Paul Atkins Begins Tenure as SEC Chairman

Paul Atkins has been elected as the 34th chairman of the U.S. SEC. The Senate held a confirmation vote for the Securities and Exchange Commission. Gary Gensler’s resignation and Mark Uyeda’s interim leadership led to his nomination.

President Donald Trump nominated Atkins to the SEC. She has a lot of experience, as she served as a commissioner from 2002 to 2008. During his earlier tenure, he navigated some of the most challenging financial periods in recent history, earning a reputation for his market insight and balanced regulatory approach.

Atkins expressed his gratitude for the honor of becoming chairman and pledged to ensure that the U.S. remains a secure location for investment and business. His management will probably give a newer tone to the SEC, one that may be more welcome to the fast-growing crypto space.

Ties to the crypto industry raise expectations

A little something from his recent Senate disclosures stood out. He has about $6 million in crypto-linked investments, specifically in companies such as Anchorage Digital and Securitize that offer crypto custody and blockchain services. His marriage to a wealthy family with business links was attributed to the delay in his confirmation, but it did not stop his appointment.

There’s a lot of speculation that, because of Atkins’ financial background and digital asset industry ties, the SEC’s stance may be shifting. His pro-innovation perspective could result in more progressive decisions, especially if the agency examines hundreds of applications for crypto-focused exchange-traded funds (ETFs).

Such an action would be a shift from the past administration, which drew ire for restricting the crypto space with its enforcement actions. The SEC may pursue a more balanced framework that encourages innovation but also protects investors under Atkins.

A Pivotal Moment for Crypto Regulation

With his appointment as the chairman of the SEC, crypto now has a balance at the top. With numerous crypto ETF applications waiting and calls for clearer regulations mounting, his actions are poised to influence the future of digital asset markets in the U.S. In particular, his return to the SEC signals a potential pivot toward policies that support technological improvement as well as market growth. Atkins could help bridge the traditional and digital financial worlds with his experience and openness to crypto.

Conclusion

With Paul Atkins leading, the SEC looks ready to start a new regulatory era that balances investor protection with innovation. With his impressive record, financial savvy, and crypto connections, he is sure to change how the agency views digital assets.

With the market waiting for decisions on the many crypto ETF filings, the industry could change as a result of Atkins taking the helm at the SEC. Everyone is watching to see how the new vision of the agency unfolds in the upcoming months.