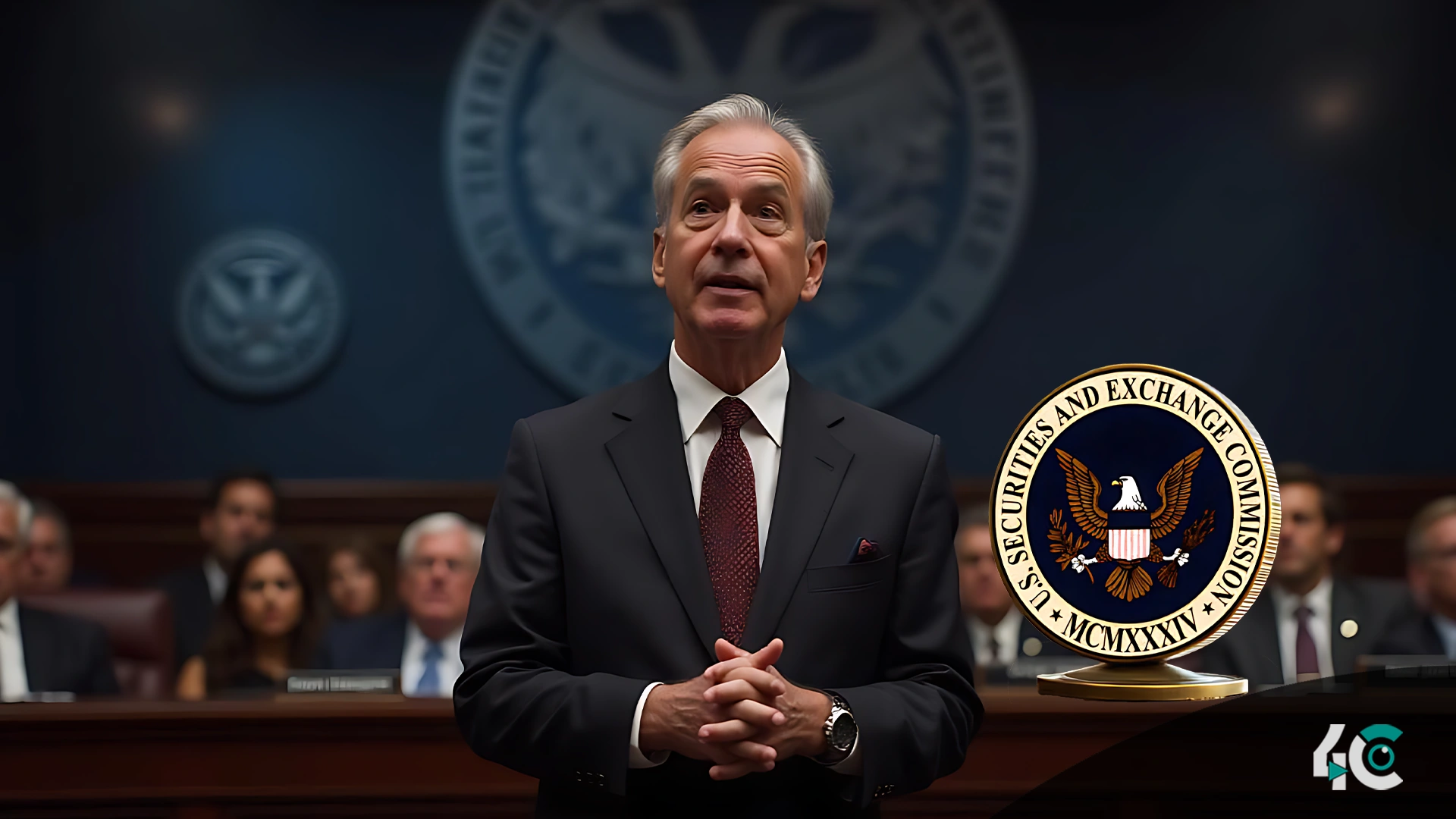

Paul Atkins has been confirmed as the new Chair of the U.S. Securities and Exchange Commission, marking a potential shift in crypto regulation. Known for his deregulatory views, Atkins is expected to adopt a pro-innovation approach that could reshape the SEC’s handling of digital assets and clarify rules for the crypto industry.

Paul Atkins takes the helm at the SEC.

Paul Atkins has taken over as the Chair of the U.S. He took the chair of the SEC with a 52-44 Senate vote. His appointment is a critical moment for the agency, especially in the area of cryptocurrency and financial market oversight.

Atkins has returned to the agency with one goal: to modernize the agency’s regulatory framework and boost innovation. President Donald Trump selected Atkins in December for his expertise in traditional finance and review processes, along with his market-friendly philosophy.

The SEC faces a leadership change at a most important time. Under the leadership of former Chair Gary Gensler, the agency has faced criticism for its enforcement actions against leading crypto firms. Gensler, Atkins promised a more balanced, transparent approach, especially regarding digital assets.

A New Approach to Crypto Regulation

Atkins stressed that the regulatory framework for crypto markets must be clear and principled during the Senate hearing. Regulatory uncertainty hinders innovation, says Atkins, who is more liberal than his predecessors.

Atkins’s strong connections to the financial sector serve him well in leading this transformation. Following his departure from the SEC in 2008, he established Patomak Global Partners, a consulting company that guides banks, cryptocurrency businesses, and financial organizations on compliance and risk management. He isn’t just a consultant in crypto; he has chaired advocacy groups and invested in companies like Anchorage Digital and Securitize.

Many Republican lawmakers back Atkins, but some Democrats are worried that he has invested in crypto and his consulting firm has ties to FTX and other financial companies. Even so, his supporters claim that he is uniquely qualified to fight for digital finance. As such, his confirmation went ahead.

Praise for market-friendly leadership.

Tim Scott, chair of the Senate Banking Committee, said Atkins’s confirmation was a “catalyst” for the SEC. Atkins’s leadership will enhance market confidence in the U.S. It also aims to restore the country’s competitiveness in the global financial system.

Atkins will be replacing acting chair Mark Uyeda and guiding the SEC through a time of considerable change in his role as chair. As per Atkins, his foremost priorities lie in instilling suitable market reforms in consideration of the changing needs of the investor.

What This Means for Crypto and Beyond

We anticipate that Atkins’s new role will foster a more collaborative and innovative SEC. We can expect the rules of crypto to be clear and predictable.

Bringing him on board will also benefit the SEC, as it will incorporate digital assets. Policies such as the STABLE Act and the GENIUS Act are already in the works, and Atkins’s influence could help shape more that further safety investors and steady innovation.

Conclusion

Paul Atkins’s confirmation as SEC Chair signals a major change in the direction of the agency, particularly regarding cryptocurrency regulation. Atkins’s reputation for supporting innovation and his understanding of digital assets could bring a new regulatory vision that ensures clarity and promotes market-friendly policies.

With the SEC taking on the challenges of an increasingly digital financial world, Atkins’s leadership may help ensure that the U.S. is always at the forefront of financial innovation around the world. This will be a fantastic chance for the crypto industry to flourish within a regulatory framework that ensures growth.