ParaSwap is addressing a significant problem in the cryptocurrency trading sphere with the introduction of its innovative Delta protocol. The new protocol aims to combat the widespread Maximal Extractable Value (MEV) attacks that have exploited tactics like sandwich transactions. Over the past month, these attacks have generated nearly $17 billion in illicit profits for the perpetrators.

This problem has become particularly severe in decentralized finance (DeFi), where attackers exploit transaction data to gain an unfair advantage.

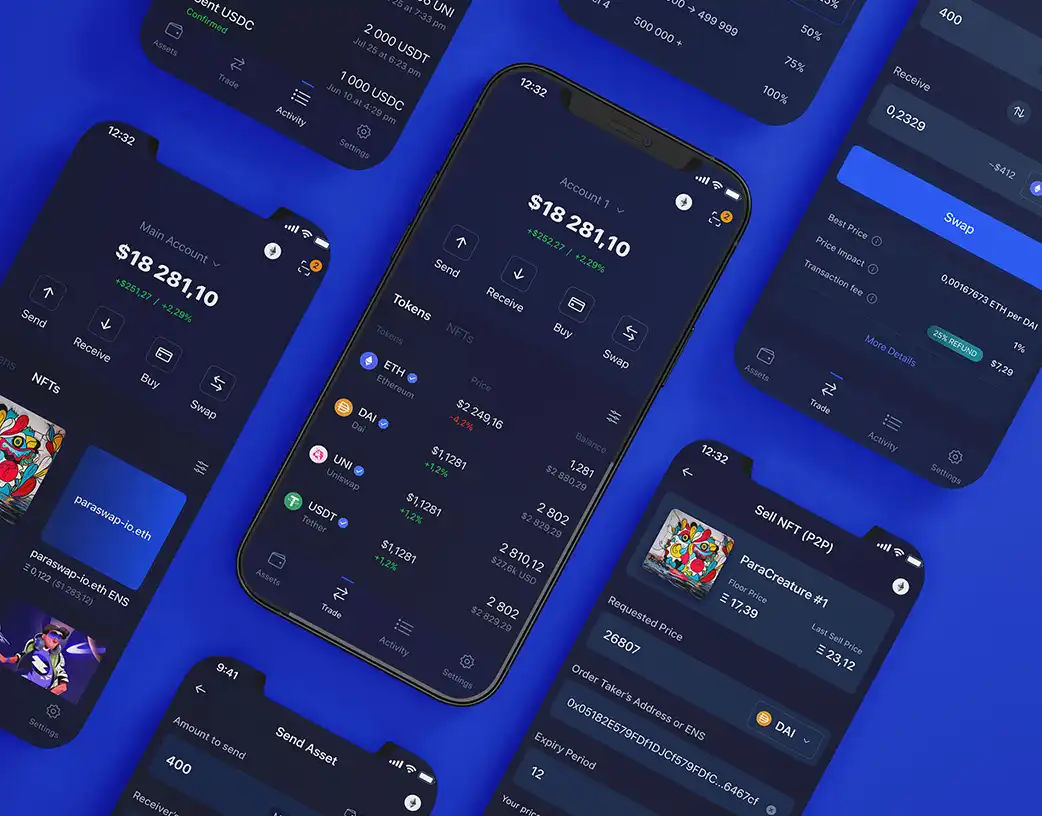

To address this, ParaSwap’s Delta protocol introduces a novel approach by allowing users to define their trading intent rather than simply submitting raw transactions to the mempool. By considering users’ specific goals, such as a target price range, during trade execution, this method aims to prevent manipulation of transactions.

In addition to ParaSwap’s efforts, other platforms like 0x are also developing strategies to counter MEV attacks by batching transactions and prioritizing them based on criteria beyond profitability.

The platform is committed to further expanding its support to additional chains and integrating automated, AI-driven strategies to enhance security and transaction efficiency in the evolving DeFi landscape.