As part of its monthly proof-of-reserves (PoR) report, crypto exchange OKX revealed that it had $7.5 billion in Bitcoin, Ether, and Tether reserves. OKX claims to have the “biggest clean asset reserves among major exchanges” based on data from blockchain analytics company CryptoQuant.

📢 Hot Off The Press 📢#OKX is proud to publish our January #ProofOfReserves audit.

— OKX (@okx) January 19, 2023

This is our 𝟑𝐫𝐝 monthly public audit showcasing 𝟏𝟎𝟎% reserve ratios for $BTC, $ETH, $USDT – the largest 𝐜𝐥𝐞𝐚𝐧 asset reserves among major exchanges.

Details: https://t.co/H59lf7Wj5S pic.twitter.com/TTvId9c3pm

According to OKX, an exchange’s reserves are only considered “clean” if a third-party analysis, in this case using the metric provided by CryptoQuant, determines that the reserves do not include the native token of the exchange and are instead comprised entirely of high-market cap “traditional” cryptocurrencies like BTC, ETH, and USDT.

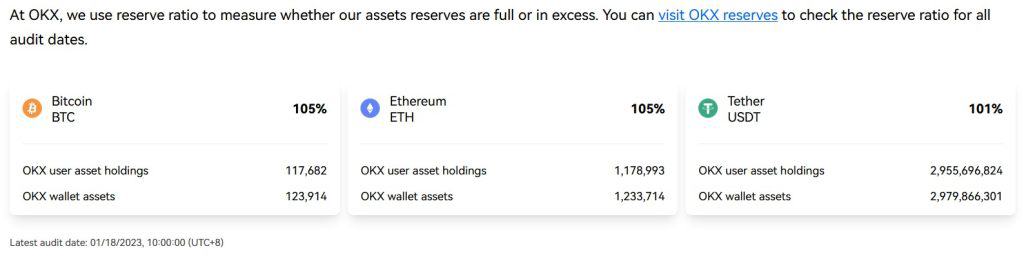

If OKX’s assertion that its reserves are 1:1 is true, then the company’s on-chain assets will exactly mirror the customer’s balances. The current reserve ratios for BTC, ETH, and USDT are shown to be 105%, 105%, and 101%, respectively.

Since CryptoQuant developed standards by which to evaluate the “cleanliness” of reserves, OKX has begun disclosing its exact asset allocation. According to CryptoQuant, this measures how committed an exchange is to its own coin. OKEx’s reserves are completely clean according to data provided by CryptoQuant. Bitfinex is 70% clean, Binance is 87% clean, and Huobi is 60% clean.

OKX announced the publication of over 23,000 addresses for its Merkle Tree PoR program, allowing users to independently check the exchange’s reserves and liabilities using trust-less tools available on the OKX website. The OKX Nansen Dashboard displays the extra assets held by the exchange.

OKX’s director of financial markets Lennix Lai made this pledge at a Hong Kong event today, promising that the exchange has never and would never steal from its users. The cryptocurrency exchange intends to utilize zero-knowledge-proof technology to increase transparency and prevent failures like the one at FTX.