Circle and MHC Digital Group are working together to make it easier for institutional buyers in Australia and the rest of the Asia-Pacific area to buy US Dollar Coin (USDC). With this partnership, the two companies hope to make it easier and cheaper for large customers to use USDC, which is becoming more important in today’s digital market.

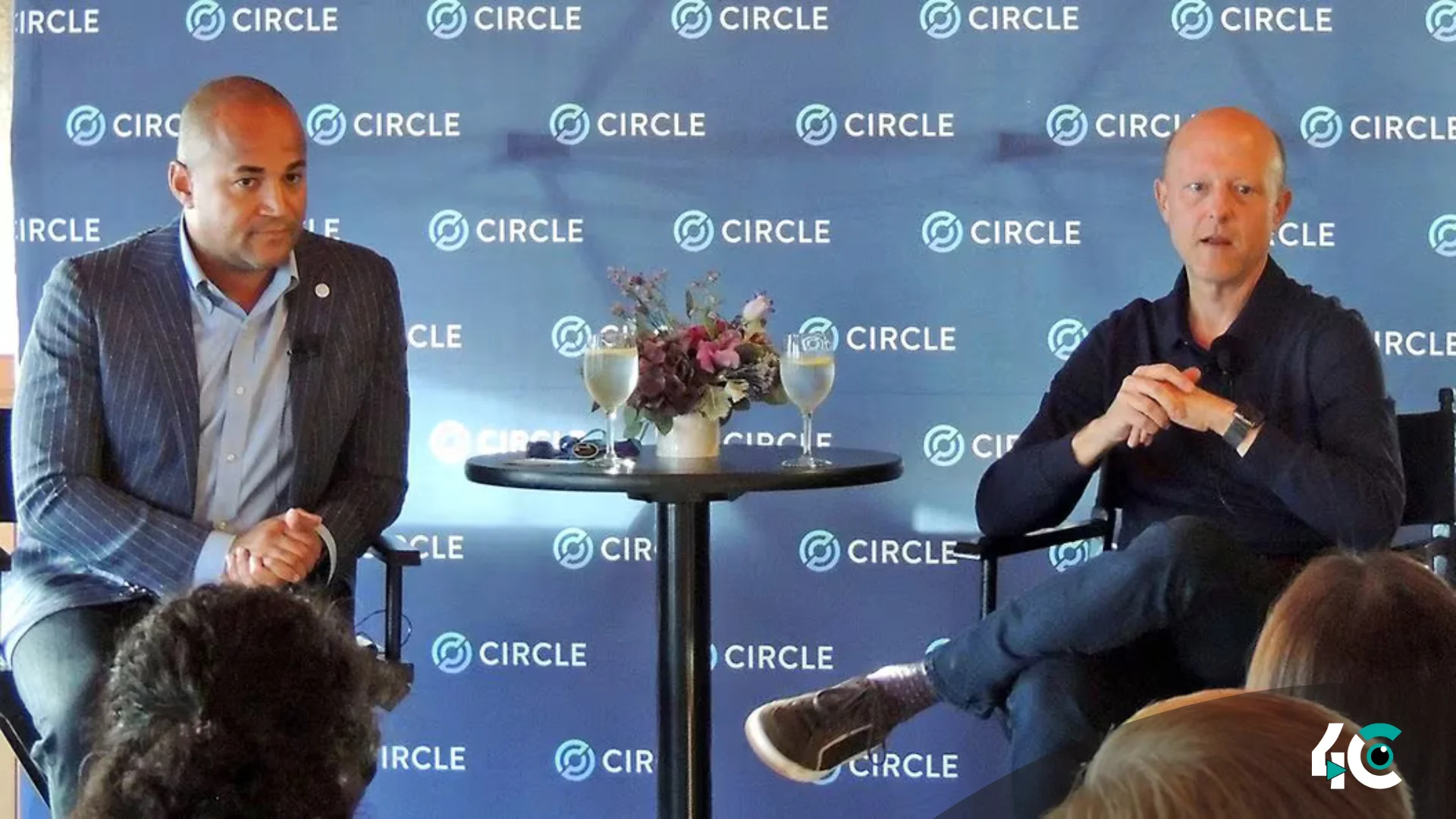

A new over-the-counter trading service is being launched by MHC Digital for wealthy people, hedge funds, and cryptocurrency companies in the area. Mark Carnegie, the founder and executive chairman of MHC Digital, was excited about the idea that Australian pension funds could use stablecoins like USDC to cut down on the costs of dealing foreign currencies. He said that these funds usually have to pay big fees to traditional banks, and he suggested that USDC could make them much more financially efficient.

Circle’s chief business officer, Kash Razzaghi, stressed that the Asia-Pacific area is ready to accept digital assets. Since most people are young and use their phones a lot, he thinks there are lots of chances for people other than big investors. It’s also possible that MHC Digital will create an Australian dollar stablecoin, which would make stablecoins even more useful in local markets.

Circles have been going global for a long time. The business is getting ready for an IPO in the US and has been working hard to establish itself in a number of different areas. It has especially made agreements in Japan and Latin America, which make it easier to use USDC through those countries’ banking systems. This growth is very important as stablecoins become better known for their ability to make payments easier and increase cash flow in financial systems around the world.

The relationship with MHC Digital in Australia is a smart move to meet the growing need for digital financial solutions. The goal of the partnership is to make USDC more widely available by focusing on institutional uses that could completely change the country’s financial situation. With the possibility of an Australian dollar stablecoin, MHC Digital and Circle are in a great situation to bring stablecoin technology to more people.

This relationship could help make Australia’s banking system work better as digital assets continue to change the way things are done. Focusing on business use cases and the possibility of making a AUD stablecoin could help Australian pension funds and other institutional investors save money and make transactions go more quickly.

Finally, the relationship between MHC Digital and Circle will make it possible for USDC to be used in the Asia-Pacific area. This is a big step toward a more advanced financial future.