Auditing firm Mazars has published a report about Binance’s BTC reserves. According to the report, Binance has enough Bitcoin and Bitcoin Cash to cover all customer balances as of November 22 at 23:59 UTC. In the wake of the failure of FTX, Binance established a proof-of-reserves website over two weeks ago to reassure its customers. According to Mazars, Binance doesn’t seem to be lying, and today’s audit only confirms that.

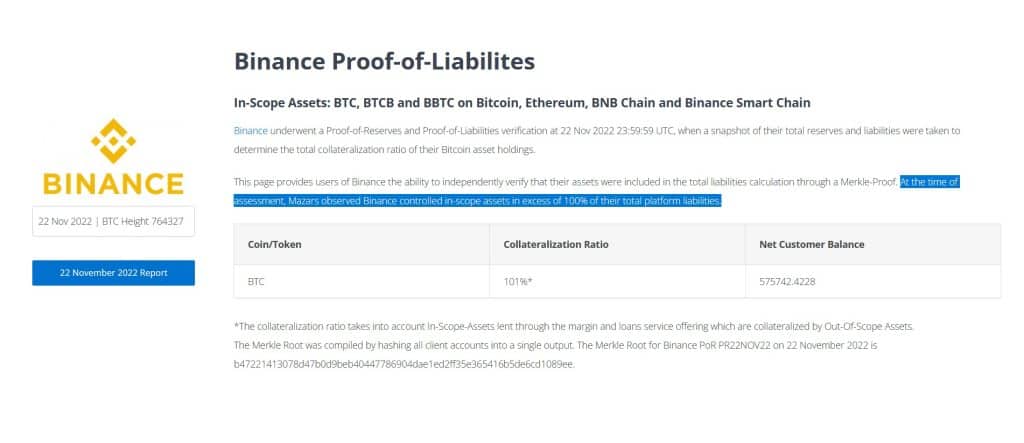

At the time of assessment, Mazars observed Binance controlled in-scope assets in excess of 100% of their total platform liabilities.

Reads the firm’s published page providing Binance’s proof-of-reserves verification

In line with Binance’s first proof of reserves report from last month, the business announced a 101% collateralization ratio on 575,742 BTC in net client deposits as of midnight UTC on November 22.

There are, as usual, caveats to these proof-of-reserves experiments. The main catch is that for the time being, Binance only supports Bitcoin assets. Unfortunately, there is currently no proof-of-reserves method for use with any other cryptocurrencies. Bitcoin may be the best-known cryptocurrency, but Binance also trades hundreds of other crypto assets.

After FTX’s collapse last month, which revealed that FTX did not have the crypto on its books to satisfy an inflow of client withdrawal requests, Binance moved rapidly to deploy its proof-of-reserves method. The disgraced CEO of the FTX exchange, Sam Bankman-Fried, acknowledged that the company was effectively letting users trade non-existent Bitcoin in a Twitter Spaces interview this week.

As part of their collateralization study, Mazars took a snapshot of Binance’s entire reserves and liabilities on November 22. Assets housed in Bitcoin, Ethereum, BNB Chain, and Binance Smart Chain included spot, options, margin, futures, financing, loan, and earn accounts for Bitcoin and Bitcoin Wrapped Wallets.