Recently certifying more than a dozen new event contracts pertaining to political outcomes in the United States, Kalshi is a U.S.-regulated prediction marketplace. This increase in agreements follows a significant court decision in September that supported the platform, thereby enabling its operations in the realm of political betting.

Unique in the U.S. market, these contracts—which operate as binary options—allow investors to stake money on different political events. These include forecasts on the forthcoming presidential contest, Senate contests, and even possible governmental resignations, such as that of New York City Mayor Eric Adams.

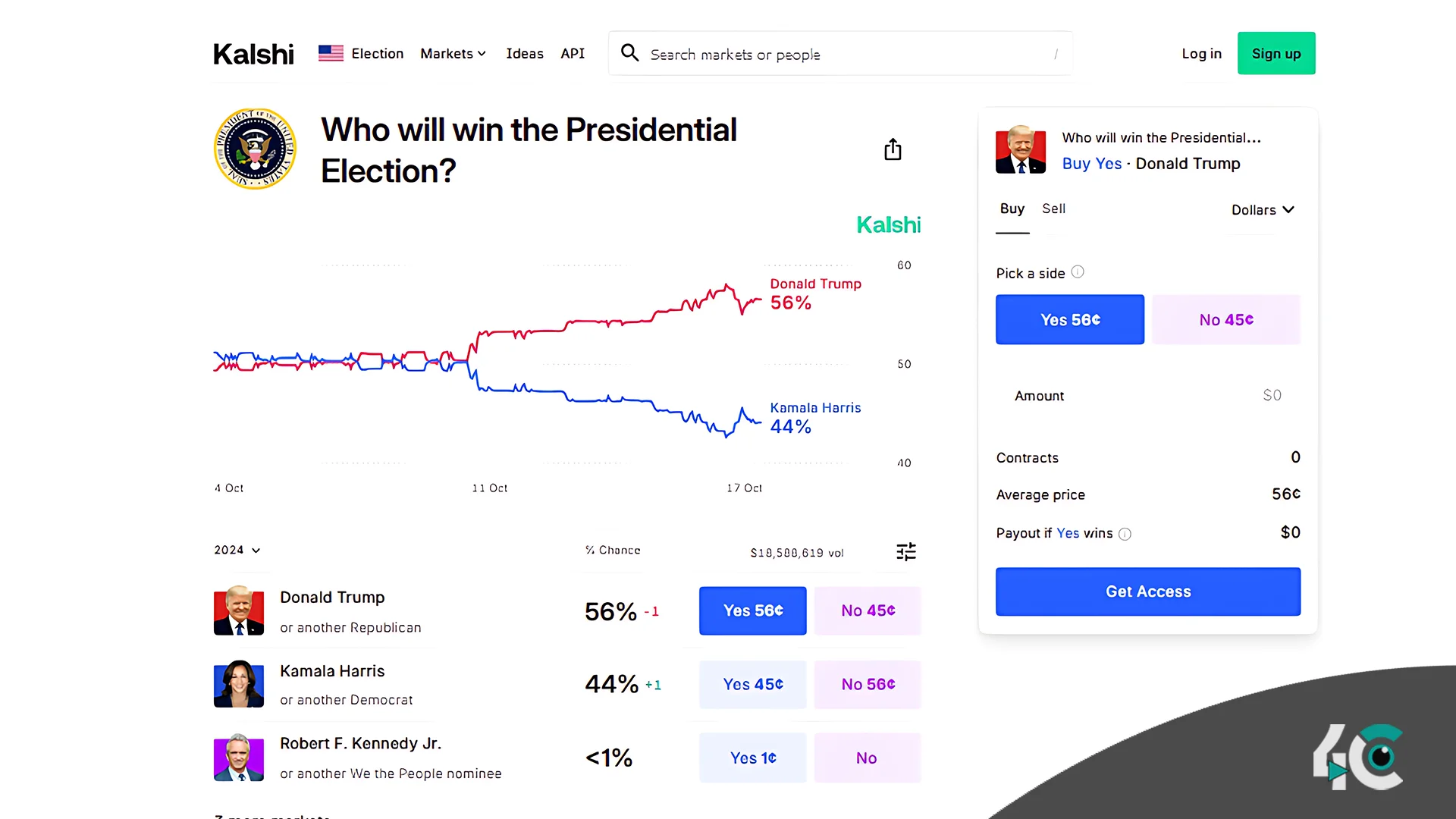

Since its launch on October 7, Kalshi’s primary presidential election betting market has generated an impressive $14 million in betting activity as of October 16.

Although Kalshi has advanced the political betting scene, Polymarket, a distributed marketplace drawing about $2 billion in wagers on the presidential campaign, still poses fierce opposition. Starting in 2020, Polymarket attracted a lot of interest in 2024 for its liberal attitude toward political event betting.

Along with a legal fight with the Commodity Futures Trading Commission (CFTC), which sought to stop the exchange from offering these political event contracts, Kalshi’s recent path includes Following a September court victory, Kalshi effectively maintained its stance in an appellate court decision on October 2. Although some experts contend such betting markets may more faithfully represent popular mood than conventional surveys, the CFTC has expressed worries that such markets might compromise electoral integrity.

As Kalshi continues to expand its offerings, we will continue to observe the consequences of this new betting environment, particularly in relation to the harmony between innovation in financial products and maintaining the integrity of electoral procedures.