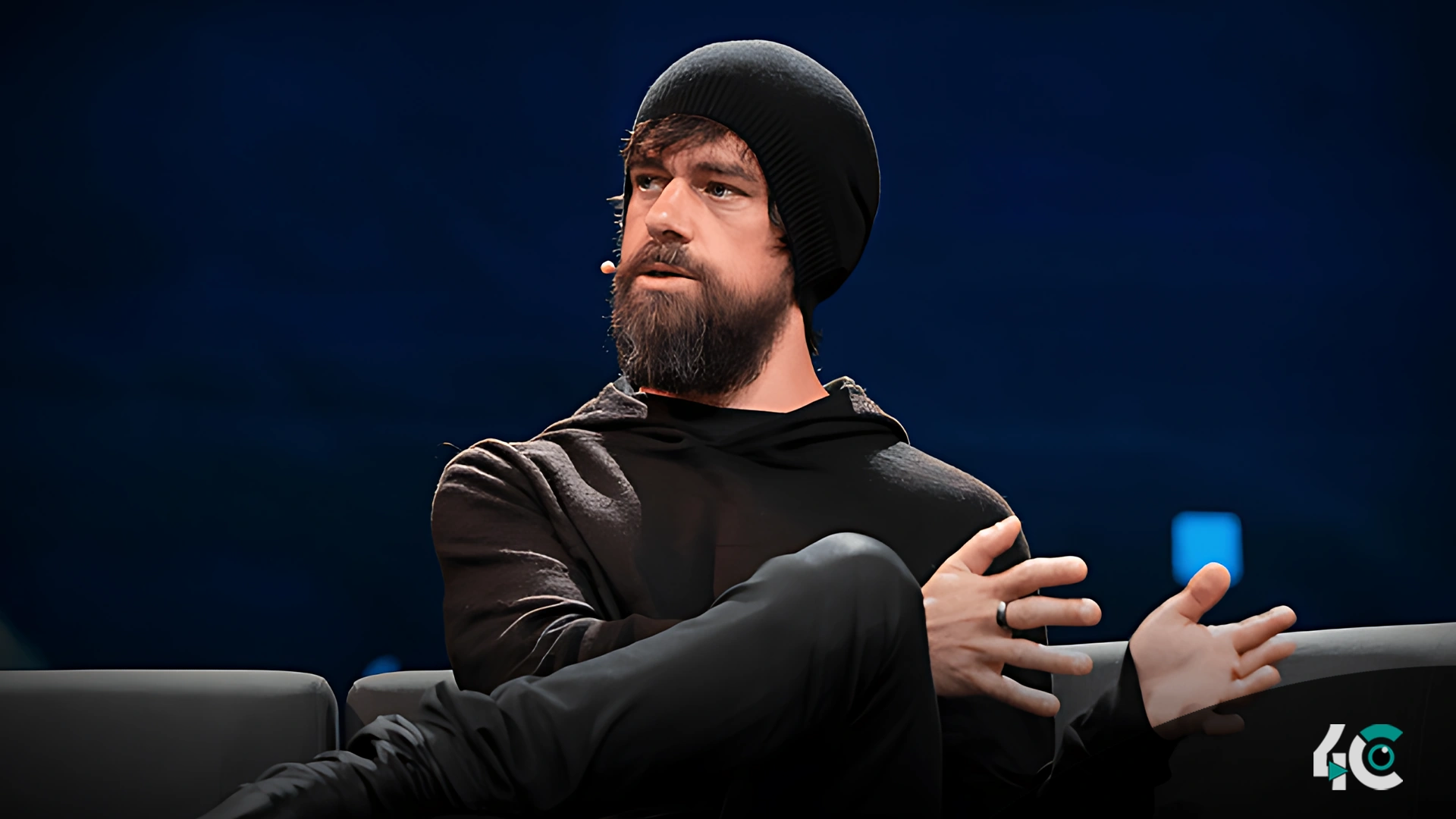

Block Inc., the payments business led by Jack Dorsey, is in talks with New York regulators to address concerns about its Anti-Money Laundering (AML) and Bitcoin compliance programs. In a recent filing with the Securities and Exchange Commission (SEC), the company stated that conversations with the New York State Department of Financial Services (NYDFS) are ongoing to seek a settlement.

According to the February 24 filing, Block is working with the NYDFS to see if a settlement can be reached on acceptable circumstances. While the specifics of the proposed resolution are unknown, the corporation has stated that it has set aside financial resources for future liabilities. However, it does not expect a substantial impact on its 2024 financial performance.

Regulatory Challenges and Previous Settlements

Block has under increased attention from financial regulators in recent years. Between January 2021 and March 2023, numerous US state regulators investigated the company’s AML procedures. These investigations purportedly revealed compliance flaws, particularly in relation to the Bank Secrecy Act.

In January, Block struck a multi-state settlement to address these violations, agreeing to pay $80 million in penalties. However, New York chose to negotiate separately with the firm rather than participate in the broader accord.

As part of the settlement with other states, Block agreed to strengthen AML standards, including hiring an independent consultant to examine and improve its compliance practices. Additionally, a Compliance Management Committee was formed to oversee the implementation of corrective actions.

Furthermore, Block is involved in a tax battle with the San Francisco Treasurer and Tax Collector. The local authorities reviewed the company’s tax filings from 2020 to 2022 and argue that additional taxes are due on money earned by Bitcoin-related operations.

Looking ahead.

While conversations with the NYDFS continue, Block is focused on enhancing its compliance structure to meet regulatory requirements. The company has also switched its strategic emphasis, with recent efforts focusing on Bitcoin mining equipment development and self-custody cryptocurrency solutions.

With continued legal and regulatory obstacles, Block’s ability to properly navigate these concerns will be critical to retaining investor trust and sustaining long-term growth in the digital payments industry.