Franklin Templeton has launched a new verification method for tokenized funds in conjunction with Jiritsu, aiming to democratize finance. Built on the Avalanche blockchain network, the solution allows for the production of tokens backed by Franklin Templeton’s EZBC and FOBXX funds. This achievement intends to make these funds available to retail investors, marking a watershed moment in the evolution of decentralized finance (DeFi).

Several blockchain networks, including Stellar, Polygon, and Avalanche, now offer the FOBXX fund, tokenized as BENJI since 2021. Previously, only registered asset managers could exchange these tokens. However, the new mechanism would provide individual investors with access to BENJI-backed derivative tokens. This invention ensures the safe backing of all tokens by actual assets, thereby breaking down barriers and increasing transparency.

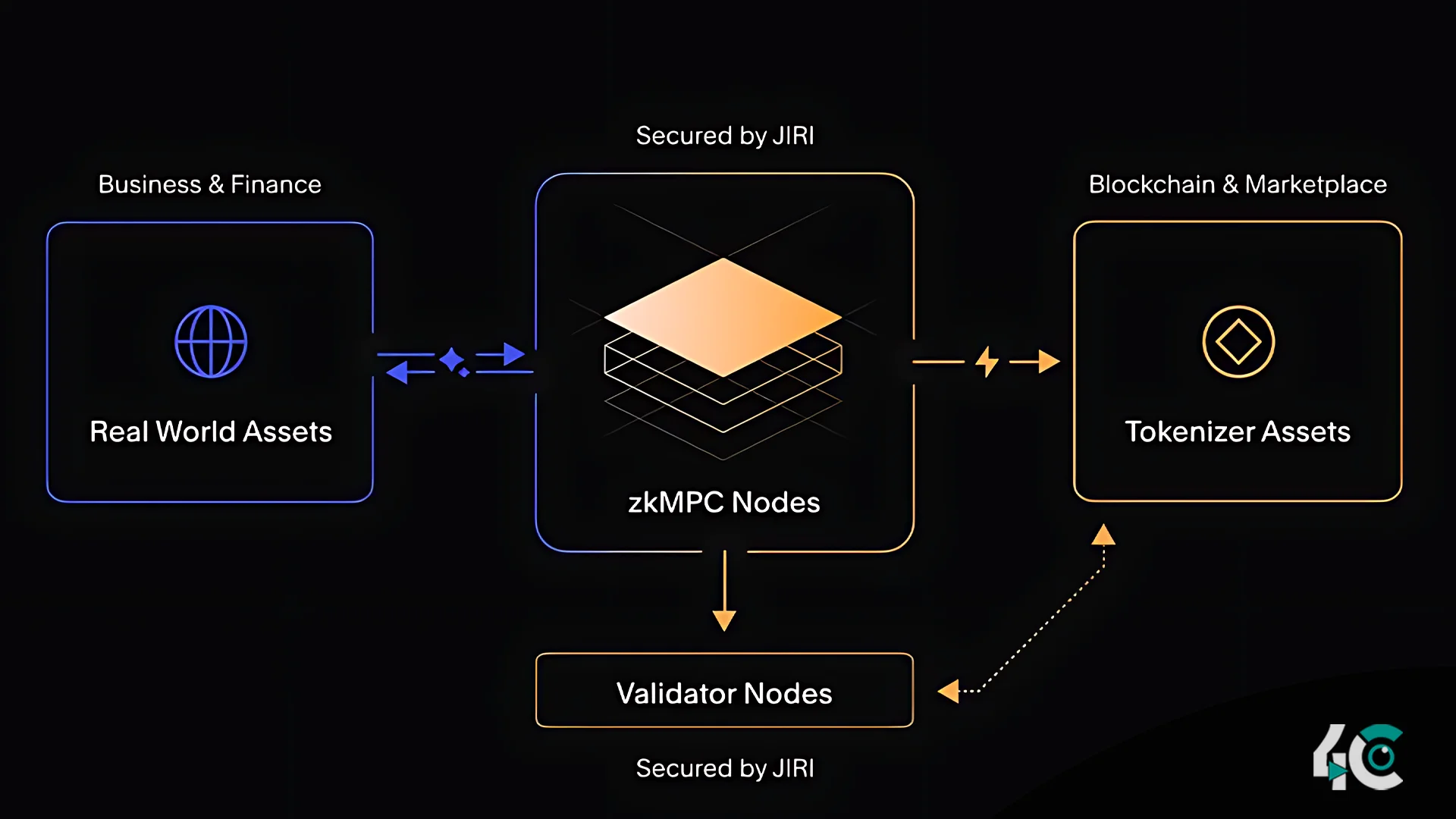

Jiritsu’s multiparty computation (MPC) network powers the verification system, preventing token issuance without adequate backup. This maintains the integrity of the token issuance process and increases investor confidence. According to Jiritsu’s co-founder, the tokens would be available to retail investors by the end of the year, as long as they pass KYC verification through an online portal.

The incorporation of tokenized assets into blockchain-based ecosystems provides various benefits to individual investors. By eliminating the need for numerous conversions between traditional assets and stablecoins, the system simplifies transactions, eliminates friction, and increases efficiency. Investors can keep tokens that directly represent fund shares and receive interest while they wait for further investment possibilities.

This breakthrough further broadens the utility of tokenized assets on DeFi platforms, allowing users to use them for a range of financial activities. Furthermore, tokenized funds offer an alternative to stablecoins for investors looking for minimal volatility and consistent returns.

Franklin Templeton is not alone in supporting tokenization. Other industry leaders, like BlackRock and ONDO, are looking into similar solutions, highlighting the enormous potential of tokenized funds in the financial world.

Projections indicate that the integration of tokenized assets will transform the global financial landscape as blockchain technology advances and more financial institutions adopt similar models. This effort is a significant step toward making new investment products available to a broader audience, enabling greater financial inclusion and efficiency in the long term.