A proposal for a spot Ethereum exchange-traded fund (ETF) was recently submitted to the Securities and Exchange Commission by the illustrious Wall Street institution Franklin Templeton, thereby intensifying the competition. Franklin Templeton, a renowned investment firm overseeing $1.4 trillion in assets, intends to introduce a fund that provides investors with exposure to ETH, the second-largest cryptocurrency by market capitalization.

The filing occurs approximately four weeks after Franklin, along with nine other issuers, introduced an ETF dedicated to spot bitcoin. The highest demand has been observed for the funds managed by asset management behemoths BlackRock’s iShares Bitcoin Trust (IBIT) and Fidelity’s Wise Origin Bitcoin Fund (FBTC). In contrast, since its inception, Franklin has experienced a comparatively lackluster commencement, garnering an estimated inflow of merely $70 million.

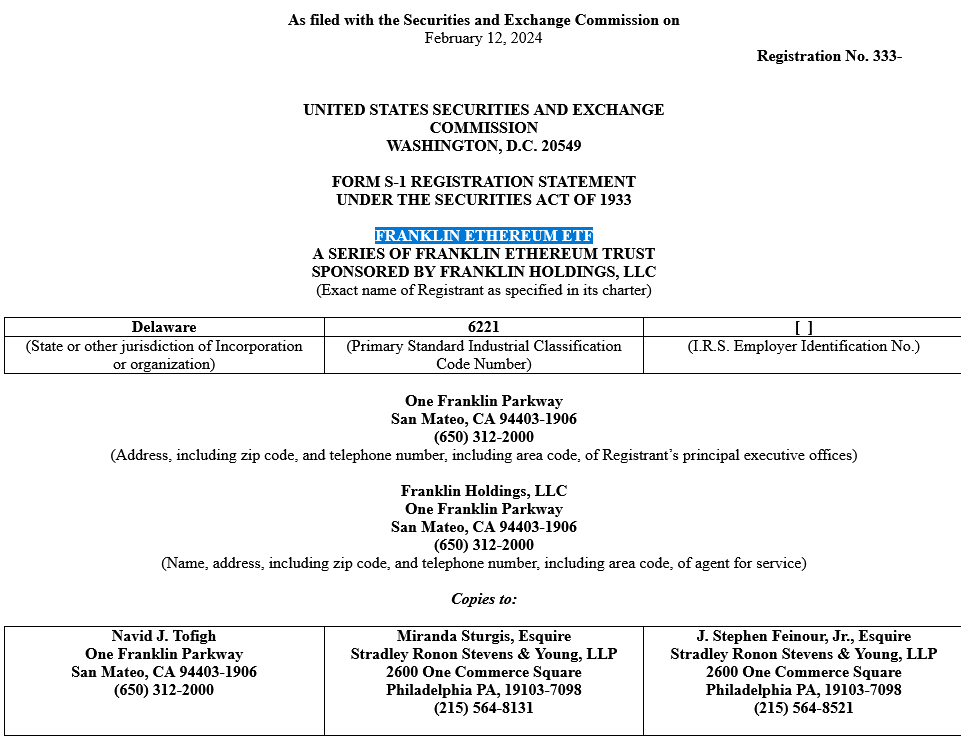

The S-1 filing was submitted by the asset management firm, valued at $1.5 trillion, to the United States Securities and Exchange Commission on February 12th. It would be designated “Franklin Ethereum ETF” if approved by the Chicago Board Options Exchange.

By tracking the market price of the underlying digital asset, spot crypto ETFs provide investors with exposure to the token without requiring them to purchase it. As a result of Franklin’s registration, eight ETF providers, all of which introduced spot bitcoin products in January, are now competing to introduce spot ether ETFs. Fidelity and BlackRock, the two largest newcomers in the spot bitcoin ETF competition, currently possess assets amounting to $3.49 billion and $4.18 billion, respectively. In contrast, Franklin Templeton is situated in close proximity to the bottom of the league table.