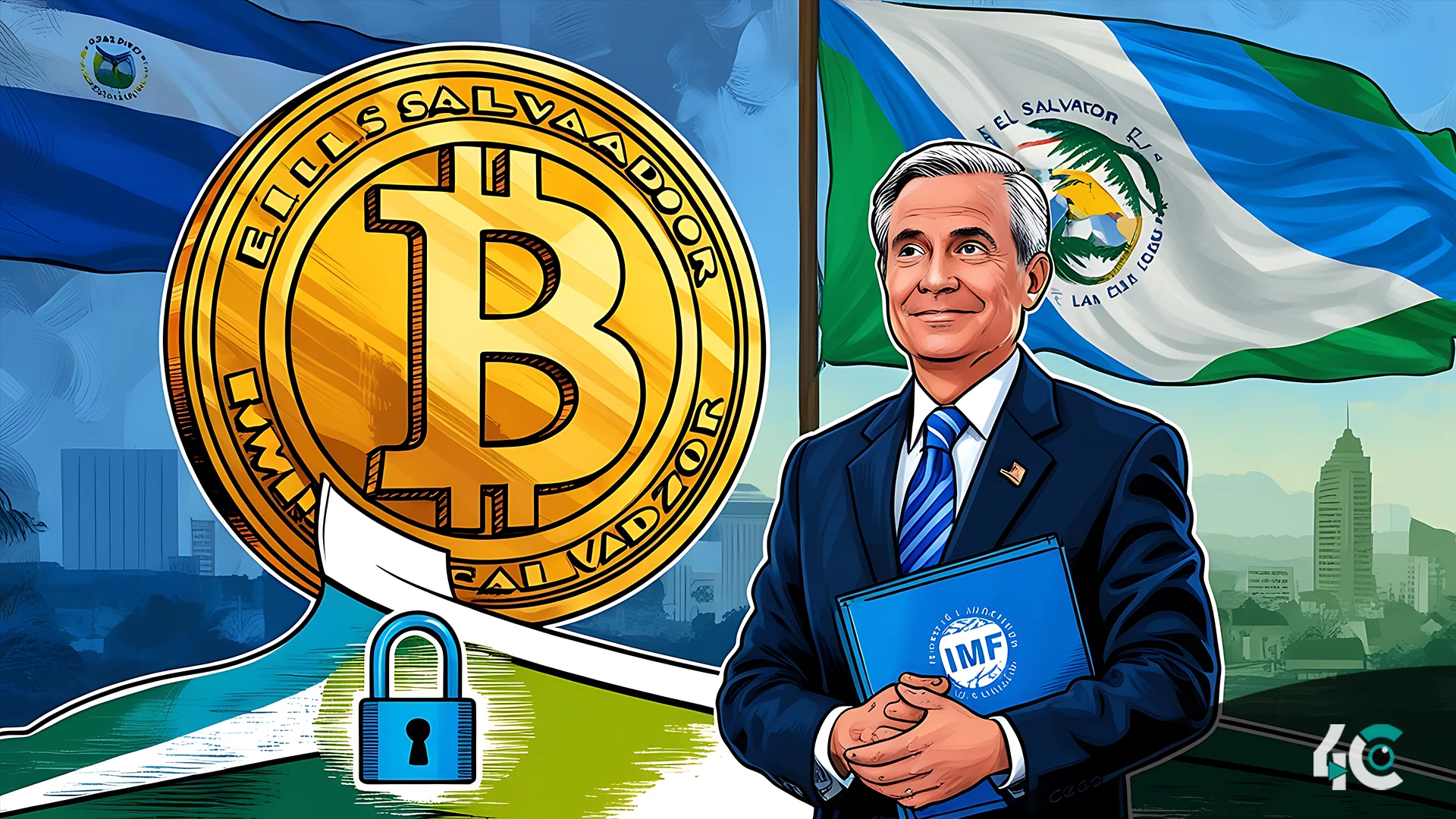

El Salvador, the first government to embrace Bitcoin as legal cash, is changing its Bitcoin policies to secure a $1.3 billion loan from the International Monetary Fund. The government intends to remove the statutory requirement for enterprises to accept Bitcoin, moving to a voluntary model. The World Bank and the Inter-American Development Bank are likely to release more funding upon completion of this change within two to three weeks.

The IMF has long opposed El Salvador’s Bitcoin proposal, citing concerns about financial stability and economic integrity. Despite criticism, President Nayib Bukele pursued his cryptocurrency-focused program, acquiring more than 5,900 Bitcoin for the country’s reserves. To get international assistance, the administration is taking a more conventional approach.

Key changes include decreasing the fiscal deficit by 3.5% of GDP in three years through tax increases and spending cuts. Furthermore, preparations are underway to increase financial reserves from $11 billion to $15 billion.

Bukele, known for his harsh approach to crime and innovative economic ideas, has received both praise and condemnation. During his first term, his assault on violent gangs drastically reduced crime, strengthening his popularity and securing his reelection with overwhelming support. Now, his administration is working to revitalize El Salvador’s economy, boost investor confidence, and strengthen ties with international institutions.

While many Salvadorans continue to prefer the US dollar for daily transactions, Bitcoin remains an important part of the government’s financial plan. The country’s reserves recently increased to more than $600 million, indicating considerable returns from Bitcoin investments.

President Bukele has also pushed for ambitious projects like the proposed Bitcoin City, which would run on geothermal energy. However, these measures are still in their early stages, as the government balances its cryptocurrency objectives with actual economic changes

El Salvador’s move to integrate with the IMF represents a watershed moment, marking a shift toward financial stability while maintaining its leadership in bitcoin adoption. This decision could create new prospects for growth and investment, allowing the country to establish a stronger economic future.