With the Crypto Anxiety & Greed Index plunging below 10—its lowest score in over two years—investor mood in the bitcoin market has descended into extreme anxiety. This slump followed Bitcoin’s dramatic fall below $85,000, raising questions reminiscent of the 2022 market crash that saw the fall-off of several prominent cryptocurrency companies.

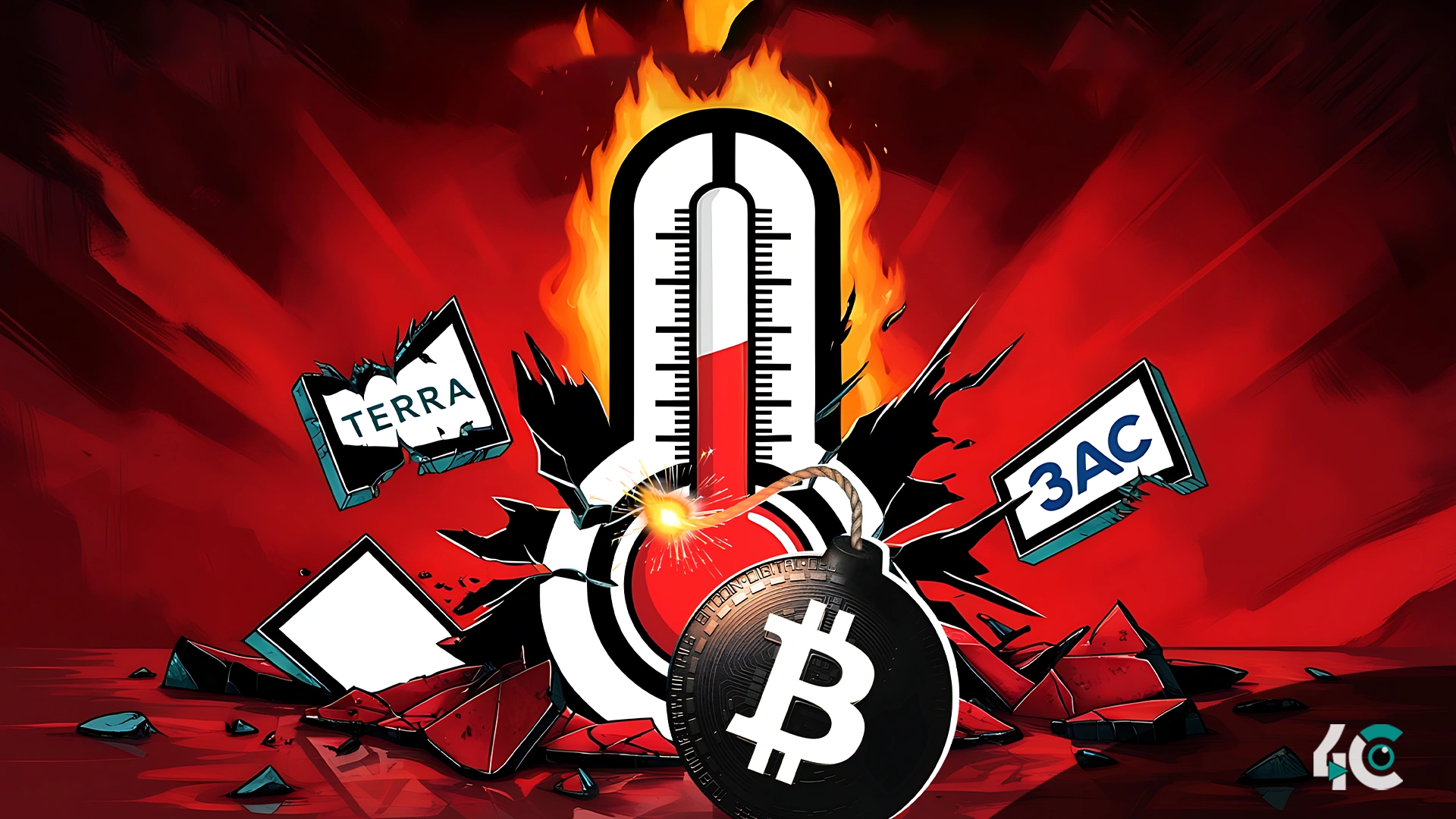

As the indicator plummeted into the acute fear area, on February 26 it indicated increasing market worry. June 2022 was the last time the index was this low; Three Arrow Capital (3AC), Terra’s LUNA and UST tokens collapsed, and Celsius banned user withdrawals as its native token declined by 90%.

Unlike the crisis of 2022, a single catastrophic event did not trigger the current market decline. Macroeconomic uncertainty appears to be rather important instead, as markets respond to geopolitical concerns and economic policy. Especially, the recent 25% tax on European goods announced by former U.S. President Donald Trump has caused market turbulence.

With 17.32% of its value lost, Bitcoin has witnessed a notable drop over the previous month and trades at about $84,408. Comparisons between the present crisis and June 19, 2022, when Bitcoin dropped to $19,000 amid widespread fear following Terra’s collapse, effectively wiping out $60 billion from the crypto economy, have been drawn.

Though there is a negative attitude, some industry experts see the situation as a possible purchase point. Ben Simpson, creator of Collective Shift, said that long-term investors have traditionally outperformed the market when they bought during times of great anxiety and sold during greed cycles. Global liquidity levels are rising, a characteristic that Swyftx head analyst Pav Hundal also pointed out has historically preceded Bitcoin recoverability.

Although the future is yet unknown, the next weeks are likely to be vital for the bitcoin market. March can be a decisive month as traders evaluate whether the market settles or undergoes more turmoil.