Bitcoin Spot ETFs: The Institutional Embrace

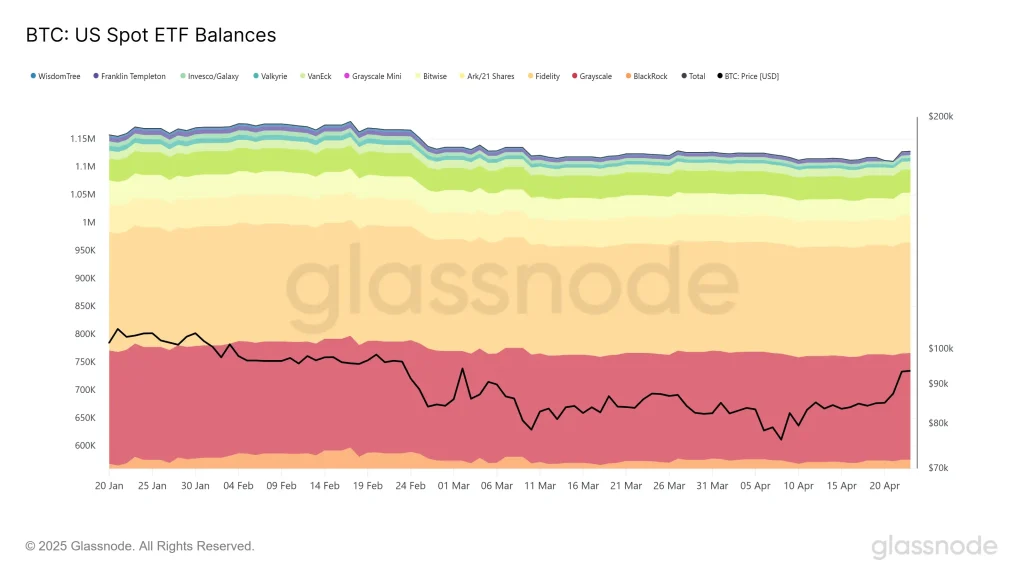

3-Month Overview: Numerous Bitcoin spot ETFs have experienced impressive inflows. Among the various Bitcoin Spot ETFs making their debut are the iShares Bitcoin Trust (IBIT) being offered by BlackRock and the Wise Origin Bitcoin Fund (FBTC) from Fidelity. These contributions have aided Bitcoin’s price stability and overall price growth as an asset.

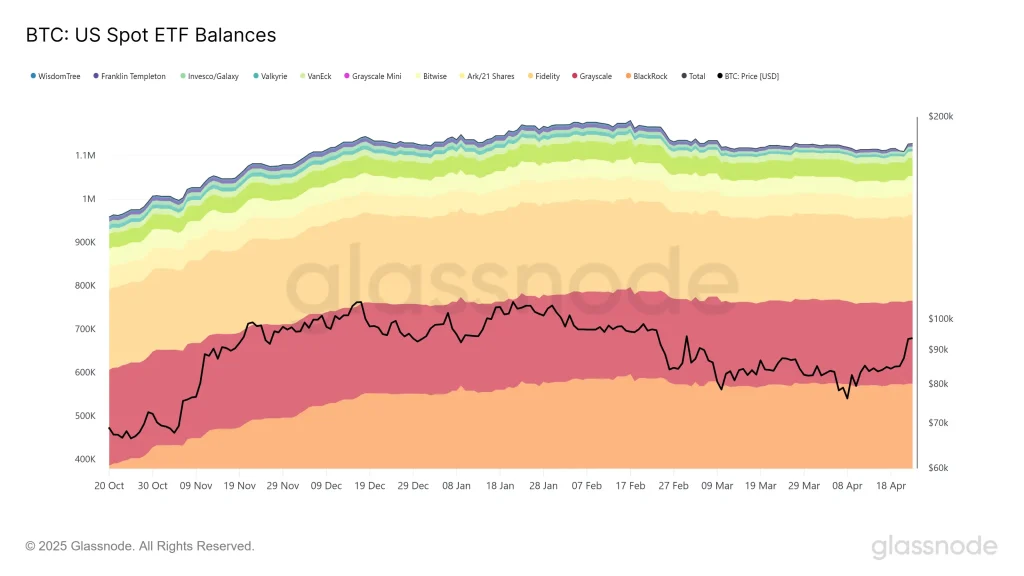

6-Month Perspective: Looking back six months the trend has continued with net inflows consistently indicating steady demand from institutional investors. Over this time, ETF providers saw greater diversification, adding depth to the market. Albeit with occasional plateaus. The interruptions generally coincide with key macroeconomic events, such as interest rate decisions or regulatory news.

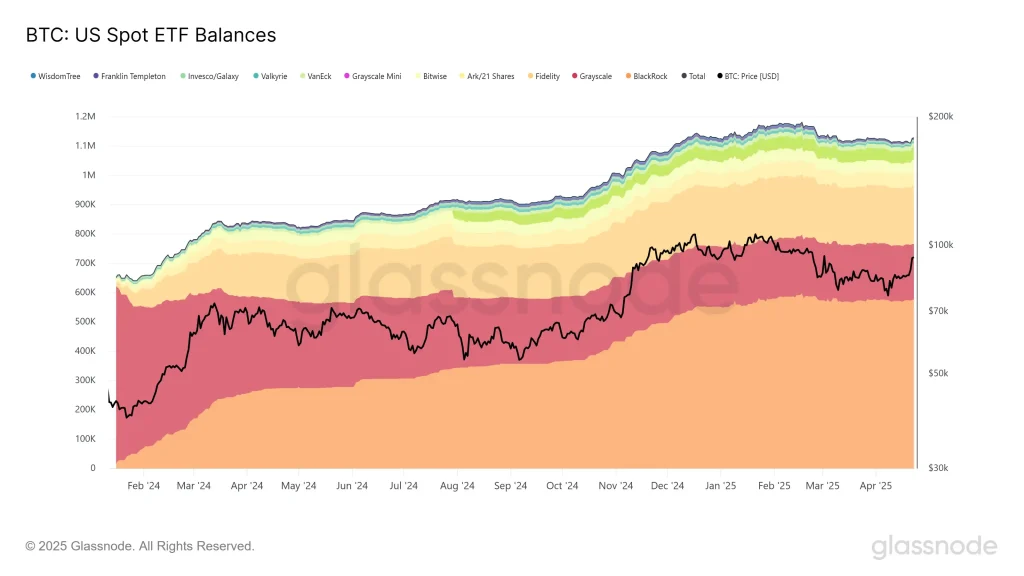

All-Time Insights: The Bitcoin Spot ETFs have garnered a large assets under management (AUM) ever since their inception which makes them an important part of the system. The conversion of Grayscale’s Bitcoin Trust (GBTC) into a Spot ETF has further increased investor access. The initial surge post-approval has stabilized, indicating growing maturity among investors.

Ethereum Spot ETFs: The Emerging Contender

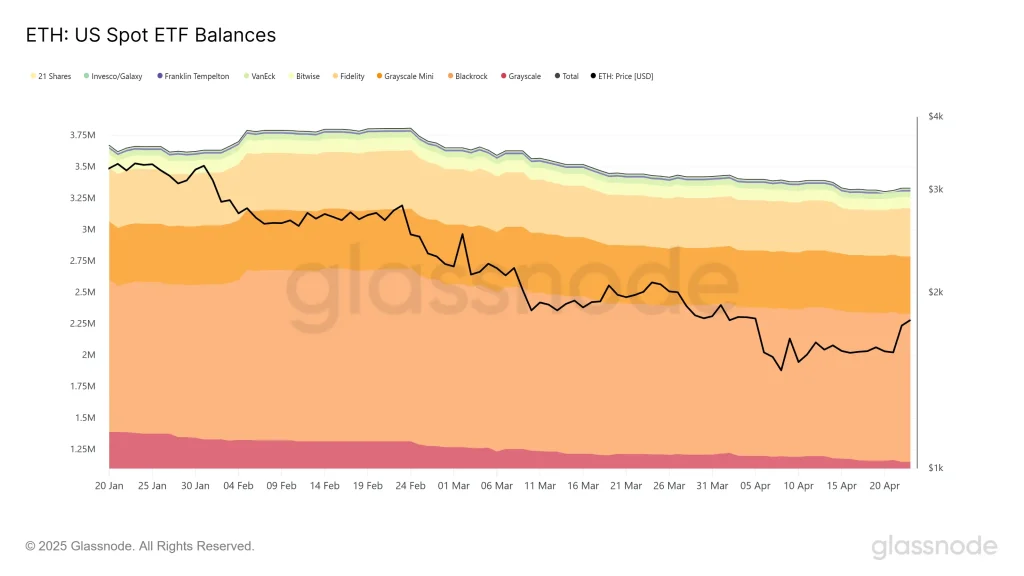

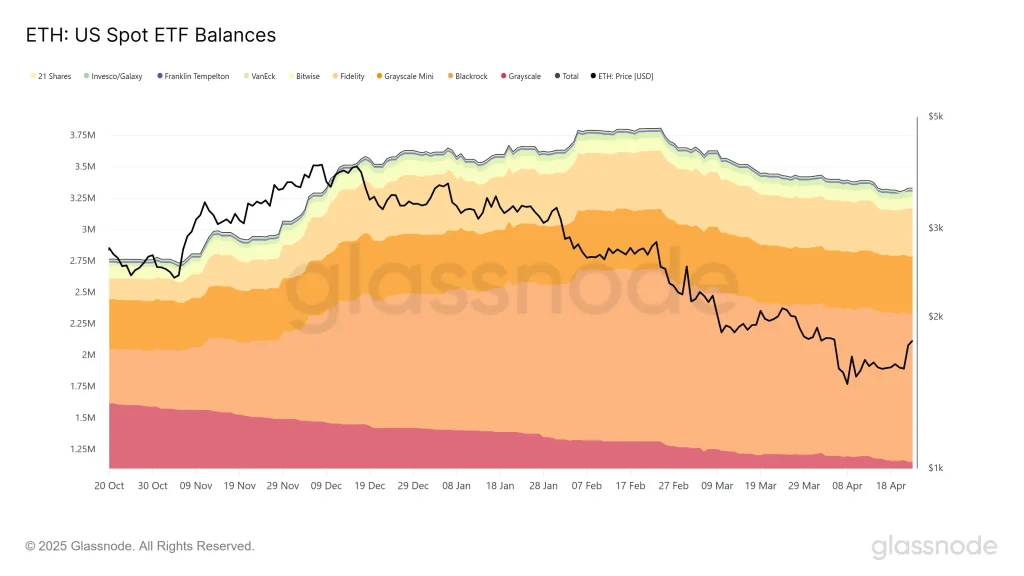

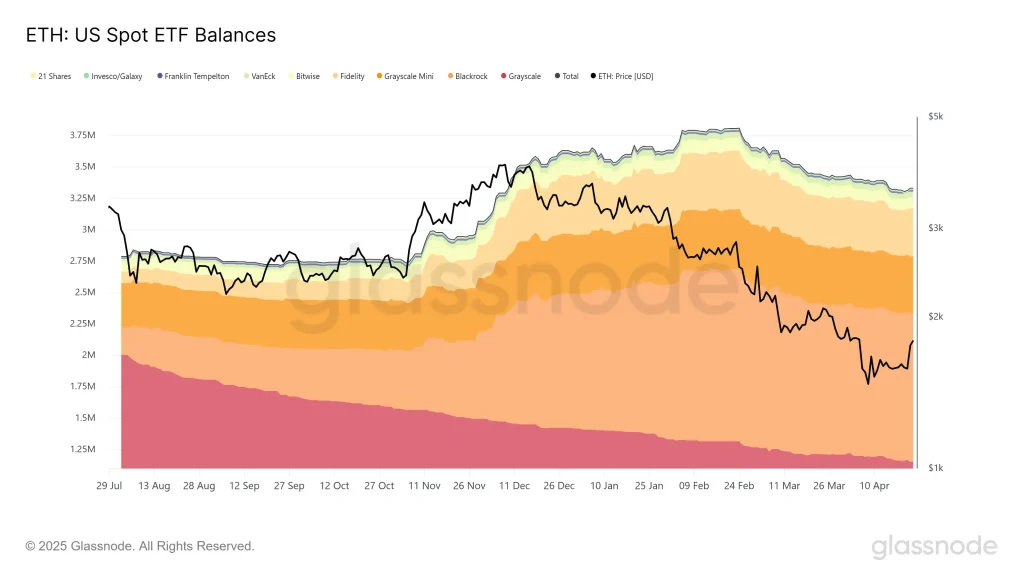

3-Month Overview: Since launching in July 2024, Ethereum Spot ETFs are becoming popular. The first additions have been promising and include Fidelity’s Ethereum Fund (FETH) and BlackRock’s iShares Ethereum Trust (ETHA). Funds such as Grayscale’s Ethereum Trust (ETHE) and VanEck’s Ethereum ETF (ETHV) have gained modest inflows as well. Some investors are concerned about the lack of staking rewards because of regulatory issues.

6-Month Perspective: In the last six months, Ethereum ETF holdings have grown steadily. While not growing as fast as the Bitcoin ETF, the steady inflows are indicative of enhanced institutional interest in Ethereum’s multiple use-cases.

All-Time Insights: Ethereum Spot ETFs are still newly launched. Nevertheless, the initial interest and gradual accumulation serve as a good base, especially with the maturing market and improving regulatory clarity.

Comparative Analysis: Bitcoin vs. Ethereum ETFs

| Metric | Bitcoin ETFs | Ethereum ETFs |

| Launch Date | January 2024 | July 2024 |

| Initial Inflows | Rapid and substantial | Moderate but steady |

| Institutional Adoption | High | Growing |

| Regulatory Constraints | More established | Still evolving |

| Market Perception | Digital Gold | Smart Contract Platform |

Although Bitcoin ETFs have gotten more attention and benefits from the “digital gold” narrative, Ethereum ETFs are finding their footing—offering something special for investors interested in DApps and smart contracts.

External Influences: Geopolitics and Market Dynamics

Changes to crypto ETFs are deeply influenced by world events:

- Regulatory Developments: The recent approval by the SEC of the Bitcoin as well as Ethereum Spot ETFs has been a huge milestone in the crypto space.

- Macroeconomic Factors: Decisions regarding interest rates, inflation and recovery from the pandemic have impacted investor sentiment and regulated ETF inflows and crypto prices.

- Technological Advancements: The popularity of Ethereum has been helped by the shift to Proof-of-Stake and other solutions for scalability. Meanwhile, Bitcoin’s Layer 2 solutions are trying to further increase the efficiency of Bitcoin transactions.

- U.S. Presidential Election 2024: Political shifts have impacted regulatory stances on cryptocurrencies, affecting investor sentiment.

Global Economic Indicators: Countries with substantial investment capabilities, such as the United States, Japan, Russia, and China, frequently influence the pricing of a wide array of commodities and currency values.

🔮 Forecast: Navigating the Road Ahead

The future of crypto ETFs appears promising:

- •Bitcoin ETFs will probably remain dominant as more institutional investors want to get into the digital asset space.

- •Ethereum ETFs are likely to grow significantly, especially if they get permission to pay staking rewards.

- •As investors learn more about the specific characteristics that make each crypto asset unique, we expect this to fuel adoption

Conclusion: Embracing the Crypto ETF Era

The Bitcoin and Ethereum Spot ETF launch is a major development in the worlds of finance and digital assets. As these offerings develop, they provide investors with diversified options to engage with the cryptocurrency economy, each with its unique risk and return potential.